Animated Delights: The Power of Creative Animation

In the fast-paced world of modern web and app design, creative animation has become a powerful tool for capturing the attention of users and creating engaging experiences. From subtle hover effects to full-screen animations, designers are constantly exploring new ways to incorporate animation into their projects.

One of the key benefits of creative animation is its ability to bring a sense of life and movement to static interfaces. Instead of simply clicking through a series of flat images and text, users are greeted with dynamic elements that respond to their interactions. This not only makes the design more visually appealing but also helps to guide users through the interface in a more intuitive way.

Creative animation can also be used to convey important information in a more engaging manner. For example, instead of displaying a boring list of features, designers can use animation to showcase each feature in a unique and memorable way. This not only helps users remember the information better but also adds an element of fun and surprise to the user experience.

Furthermore, creative animation can be used to create a sense of continuity and flow throughout a design. By using consistent animations for transitions between pages or sections, designers can help users navigate the interface more easily and create a cohesive overall experience. This can also help to establish a brand identity and make the design more memorable to users.

Image Source: ytimg.com

Another key aspect of creative animation is its ability to evoke emotion and create a more immersive experience. By incorporating subtle animations that respond to user interactions, designers can make users feel more connected to the interface and encourage them to explore further. This can be especially powerful in storytelling or interactive experiences where emotion plays a key role in engaging the user.

Overall, creative animation plays a crucial role in modern web and app design by adding a layer of depth and interactivity to interfaces. By using animation strategically, designers can create more engaging experiences that capture the attention of users and make a lasting impression. So next time you’re designing a website or app, don’t be afraid to unleash the power of creative animation and see the delightful impact it can have on your project.

Revolutionizing Design: The Impact on Web and Apps

In today’s fast-paced digital world, the use of creative animation has revolutionized the way we design and interact with websites and mobile applications. From eye-catching loading screens to interactive menus, animations have become a powerful tool for engaging users and enhancing the overall user experience.

One of the key impacts of creative animation in modern web and app design is its ability to capture the attention of users. In a world where our attention spans are shorter than ever, animations have the power to quickly draw users in and keep them engaged. Whether it’s a subtle hover effect on a button or a dynamic background that changes as you scroll, animations can make a website or app feel alive and dynamic.

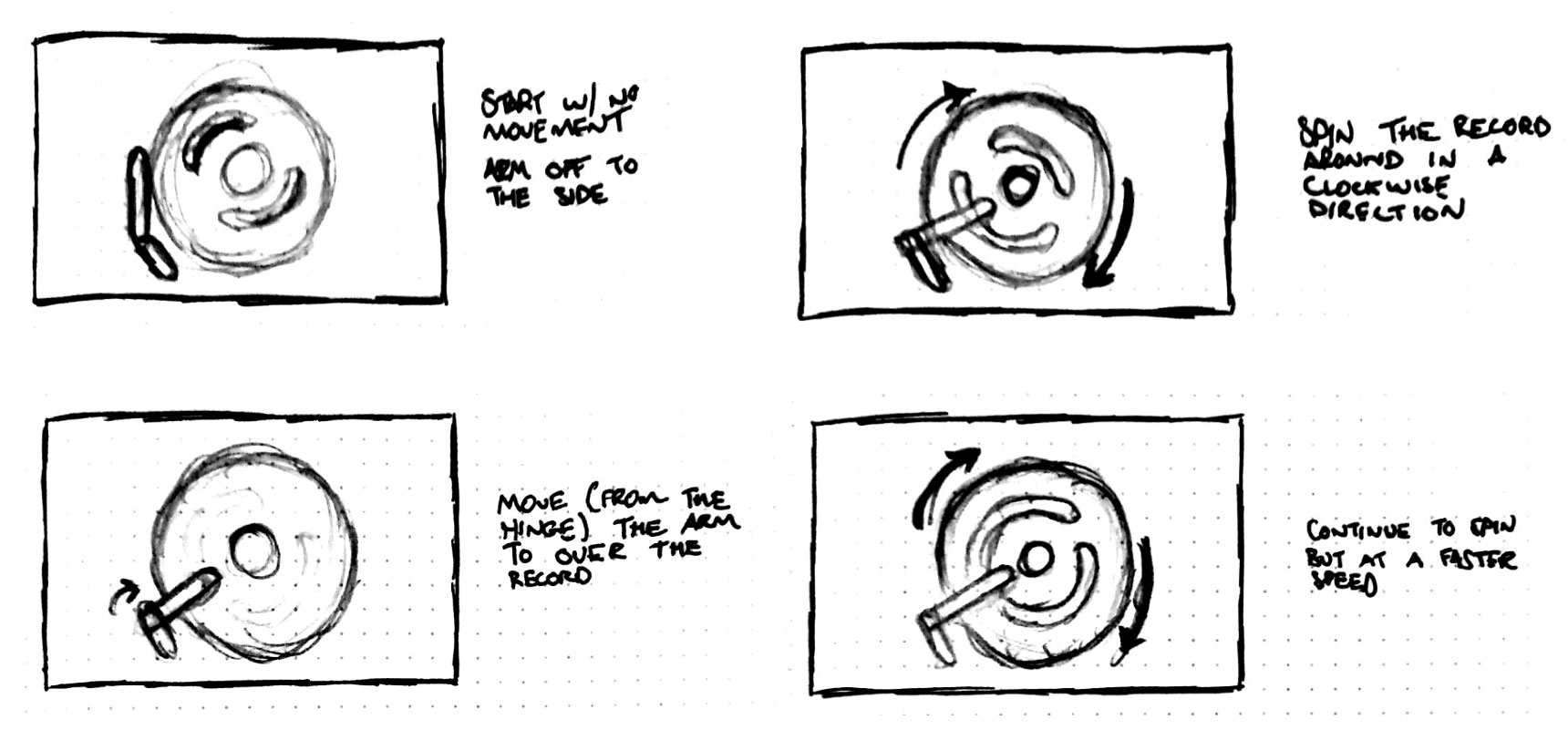

But it’s not just about grabbing attention – creative animation can also help guide users through a website or app, making navigation more intuitive and enjoyable. For example, a well-designed animation can indicate to users where they should click next or provide feedback on their actions, helping to reduce confusion and improve the overall user experience.

Image Source: medium.com

Another way that creative animation is revolutionizing design is by adding a sense of personality and branding to websites and apps. By incorporating unique animations that reflect a brand’s identity, designers can create a more memorable and engaging experience for users. Whether it’s a playful animation that reinforces a brand’s fun and quirky image or a sleek and minimalist animation that conveys a sense of sophistication, animations can help to establish a strong brand presence online.

In addition to enhancing the visual appeal of websites and apps, creative animation can also improve functionality. Animations can be used to communicate information quickly and effectively, such as illustrating complex concepts or guiding users through a multi-step process. By using animations strategically, designers can make websites and apps more user-friendly and intuitive, ultimately leading to higher user satisfaction and retention.

Furthermore, creative animation can also be used to create emotional connections with users. By incorporating animations that evoke specific emotions, designers can create a more immersive and engaging experience that resonates with users on a deeper level. Whether it’s a heartwarming animation that celebrates a user’s achievements or a whimsical animation that brings a smile to their face, animations have the power to create meaningful and memorable interactions.

Overall, the impact of creative animation on modern web and app design is undeniable. From capturing attention and guiding users to enhancing branding and functionality, animations have become an essential tool for creating engaging and immersive digital experiences. As technology continues to evolve, we can expect to see even more innovative uses of animation in web and app design, pushing the boundaries of creativity and enhancing the way we interact with digital content.

Image Source: website-files.com

Creative Animation Use in Web & App Design

Image Source: orpetron.com

Image Source: deliveredsocial.com

Image Source: orpetron.com

Image Source: format.com

Image Source: futurecdn.net

Image Source: entheosweb.com