Digital Marketing Mastery: Unlocking Success

In today’s fast-paced digital world, it’s essential for digital marketing experts to master a variety of job roles in order to excel in their careers. From social media management to search engine optimization, there are a multitude of skills that can help professionals stand out in the competitive job market. In this article, we will explore the top 5 job roles that every digital marketing expert should master in order to unlock success in their careers.

1. Content Creation and Marketing:

One of the most important job roles for a digital marketing expert to master is content creation and marketing. Content is king in the digital world, and having the ability to create engaging and relevant content is essential for driving traffic and generating leads. Whether it’s writing blog posts, creating videos, or designing infographics, content creation is a crucial skill that can set digital marketing experts apart from their competitors.

In addition to creating content, digital marketing experts must also understand how to effectively market that content to their target audience. This includes utilizing social media platforms, email marketing, and search engine optimization to promote their content and reach a larger audience. By mastering the art of content creation and marketing, digital marketing experts can drive more traffic to their websites and ultimately increase their conversions.

2. Social Media Management:

Another key job role for digital marketing experts to master is social media management. With billions of users on platforms like Facebook, Instagram, and Twitter, social media has become a powerful tool for businesses to connect with their customers and promote their products or services. Digital marketing experts must understand how to create engaging social media posts, interact with followers, and analyze social media metrics in order to effectively manage their brand’s online presence.

Image Source: allassignmenthelp.com

By mastering social media management, digital marketing experts can build brand awareness, increase engagement, and drive traffic to their websites. They can also leverage social media advertising to reach a larger audience and generate leads. In today’s digital age, social media management is a job role that every digital marketing expert should master in order to stay competitive in the industry.

3. Search Engine Optimization (SEO):

Search engine optimization, or SEO, is another essential job role for digital marketing experts to master. SEO is the process of optimizing a website to rank higher in search engine results pages, which can lead to increased visibility and organic traffic. By understanding how search engines like Google rank websites and implementing SEO best practices, digital marketing experts can improve their website’s search engine rankings and attract more visitors.

In addition to on-page and off-page SEO techniques, digital marketing experts must also understand the importance of keyword research, link building, and content optimization. By mastering SEO, digital marketing experts can drive more organic traffic to their websites, increase their conversions, and ultimately grow their businesses. SEO is a fundamental skill that every digital marketing expert should master in order to succeed in the competitive online landscape.

4. Email Marketing:

Email marketing is another key job role for digital marketing experts to master. With an average return on investment of $42 for every $1 spent, email marketing is one of the most cost-effective and efficient ways to reach customers and generate leads. Digital marketing experts must understand how to create compelling email campaigns, segment their email lists, and analyze email metrics in order to maximize their email marketing efforts.

By mastering email marketing, digital marketing experts can build relationships with their customers, drive traffic to their websites, and increase their conversions. They can also use email marketing to promote their products or services, announce special offers, and engage with their audience. Email marketing is a job role that every digital marketing expert should master in order to effectively communicate with their customers and drive sales.

Image Source: ctfassets.net

5. Data Analysis and Reporting:

Lastly, data analysis and reporting is a crucial job role for digital marketing experts to master. In order to track the success of their marketing campaigns and make informed decisions, digital marketing experts must understand how to analyze data, interpret metrics, and create comprehensive reports. By analyzing key performance indicators such as website traffic, conversion rates, and return on investment, digital marketing experts can identify trends, optimize their strategies, and achieve their business goals.

By mastering data analysis and reporting, digital marketing experts can gain valuable insights into their marketing efforts, measure their success, and make data-driven decisions. They can also use data to identify areas for improvement, test different marketing tactics, and continuously optimize their campaigns. Data analysis and reporting is a job role that every digital marketing expert should master in order to track their progress, measure their results, and stay ahead of the competition.

In conclusion, mastering these top 5 job roles can help digital marketing experts unlock success in their careers. By becoming proficient in content creation and marketing, social media management, search engine optimization, email marketing, and data analysis and reporting, digital marketing experts can stand out in the competitive job market and achieve their business goals. Whether you’re a seasoned digital marketing professional or just starting out in the industry, mastering these job roles is essential for success in today’s digital world.

2. Essential Job Roles to Excel!

Are you a digital marketing expert looking to unlock success in your career? One of the key factors to achieving success in the world of digital marketing is mastering essential job roles that will help you excel in your field. In this article, we will explore the top 5 job roles that every digital marketing expert should master in order to reach new heights in their career.

1. Content Creator:

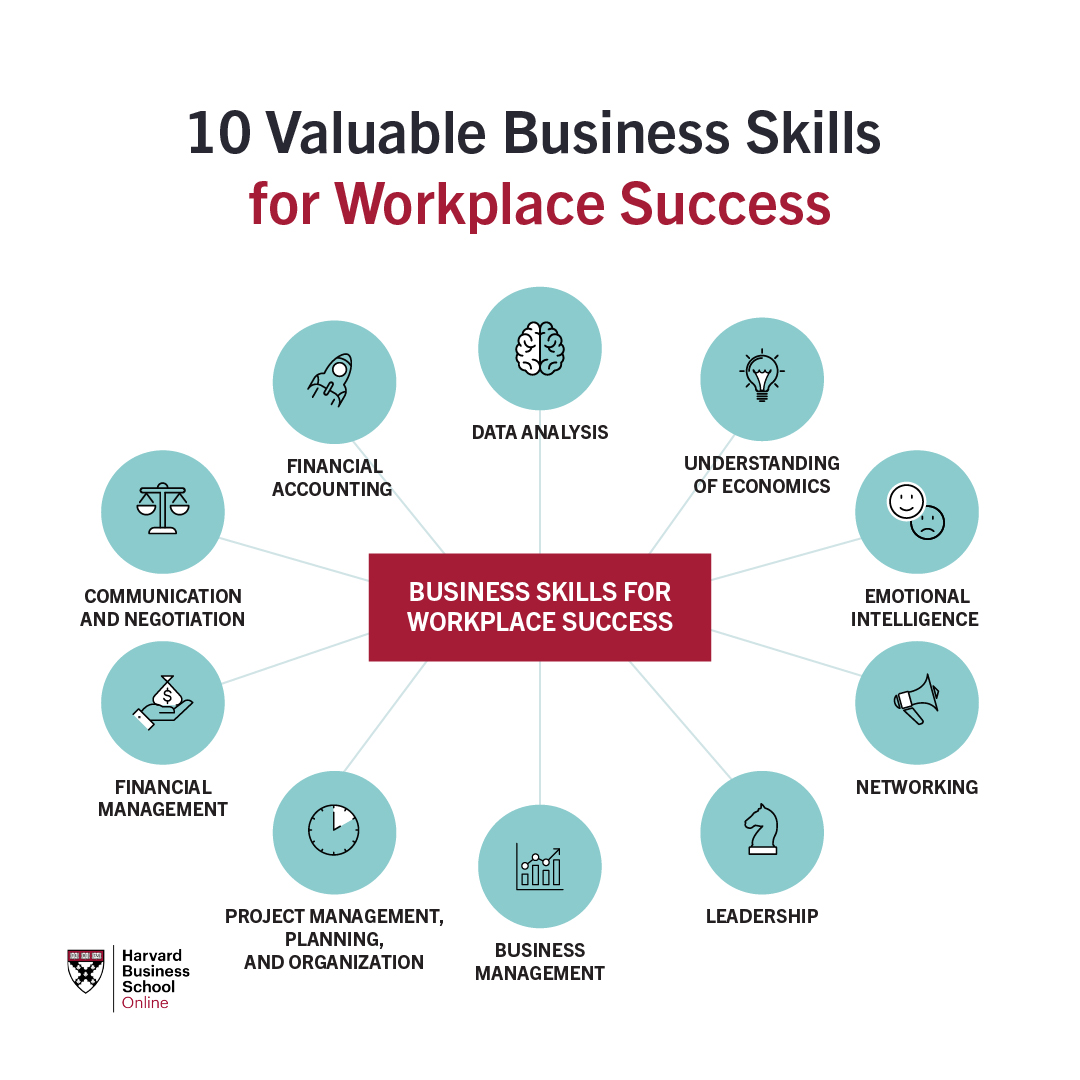

Image Source: hbs.edu

Content is king in the world of digital marketing, and as a digital marketing expert, being able to create high-quality and engaging content is essential. Whether it’s writing blog posts, creating social media posts, or producing videos, content creation is a crucial skill that can set you apart from the competition. By mastering the art of content creation, you can effectively communicate your message to your target audience and drive engagement and conversions.

2. SEO Specialist:

Search engine optimization (SEO) is the backbone of digital marketing, and every digital marketing expert should have a strong understanding of SEO principles. By mastering SEO, you can ensure that your content is easily discoverable by search engines and that your website ranks high in search engine results pages. This will not only drive organic traffic to your website but also increase your brand visibility and credibility in the eyes of your target audience.

3. Social Media Manager:

Social media has become an integral part of digital marketing, and as a digital marketing expert, being able to effectively manage and optimize social media channels is essential. By mastering social media management, you can engage with your audience, build brand awareness, and drive traffic to your website. Additionally, social media is a great platform for building relationships with your customers and creating brand loyalty.

Image Source: ctfassets.net

4. Data Analyst:

In the world of digital marketing, data is king, and being able to effectively analyze and interpret data is essential for making informed decisions. As a digital marketing expert, mastering data analysis can help you track the performance of your campaigns, identify trends and patterns, and optimize your marketing strategies for better results. By understanding key performance indicators (KPIs) and using data analytics tools, you can gain valuable insights that will help you drive success in your digital marketing efforts.

5. Email Marketing Specialist:

Email marketing remains one of the most effective digital marketing channels, and as a digital marketing expert, being able to create and optimize email campaigns is essential. By mastering email marketing, you can effectively communicate with your audience, nurture leads, and drive conversions. Additionally, email marketing allows you to personalize your messaging and target specific segments of your audience, leading to higher engagement and ROI.

In conclusion, mastering these essential job roles is key to unlocking success as a digital marketing expert. By becoming a skilled content creator, SEO specialist, social media manager, data analyst, and email marketing specialist, you can set yourself apart from the competition and achieve new heights in your career. So, what are you waiting for? Start mastering these essential job roles today and watch your digital marketing career soar to new heights!

Image Source: tiktok.com

Top 5 Job Roles Every Digital Marketing Expert Should Know

Image Source: price2spy.com

Image Source: berlinsbi.com

Image Source: hbs.edu

Image Source: cloudfront.net