Mastering the Digital Landscape: Key Skills for 2025

As we look ahead to the year 2025, the digital marketing landscape is constantly evolving and changing. In order to stay ahead of the curve and future-proof your career in digital marketing, it is essential to master a set of key skills that will be crucial for success in the years to come.

One of the most important skills to master in the digital landscape of 2025 is data analysis. With the rise of big data and analytics, being able to interpret and make data-driven decisions will be essential for digital marketers. Understanding how to collect, analyze, and interpret data will allow marketers to optimize their campaigns and target their audience more effectively.

Another key skill for success in 2025 is content creation and storytelling. With the increasing amount of content being produced online, marketers need to be able to create compelling and engaging content that will capture the attention of their audience. Being able to tell a story through content will help marketers stand out in a crowded digital landscape and connect with consumers on a deeper level.

In addition to data analysis and content creation, another key skill for digital marketers in 2025 is social media management. Social media platforms continue to be a vital tool for marketers to reach their audience and build brand awareness. Being able to effectively manage social media accounts, create engaging content, and interact with followers will be essential for success in the digital landscape of 2025.

Image Source: aiivine.com

Furthermore, search engine optimization (SEO) will continue to be a crucial skill for digital marketers in 2025. With the increasing competition online, marketers need to understand how to optimize their websites and content to rank higher in search engine results. Mastering SEO techniques will help marketers drive more organic traffic to their websites and increase their online visibility.

In addition to these key skills, digital marketers in 2025 will also need to have a strong understanding of emerging technologies such as artificial intelligence (AI) and virtual reality (VR). These technologies are shaping the future of marketing and being able to leverage them effectively will be essential for staying ahead of the curve.

Overall, mastering the digital landscape and acquiring these key skills will be crucial for success in the ever-changing world of digital marketing. By staying ahead of the curve and continually learning and adapting to new trends and technologies, digital marketers can future-proof their careers and thrive in 2025 and beyond.

Staying Ahead of the Curve: Strategies for Success

As we look towards the year 2025, the digital marketing landscape continues to evolve at a rapid pace. With new technologies and trends emerging constantly, it is more important than ever to stay ahead of the curve in order to succeed in this competitive field. In this article, we will discuss some key strategies to future-proof your digital marketing career and ensure your success in 2025 and beyond.

One of the most important strategies for staying ahead of the curve in digital marketing is to continually educate yourself and stay up-to-date on the latest trends and technologies. This may involve taking online courses, attending conferences, or simply staying active in online communities and forums where industry news and insights are shared. By staying informed, you can ensure that you are always aware of the latest best practices and strategies in digital marketing.

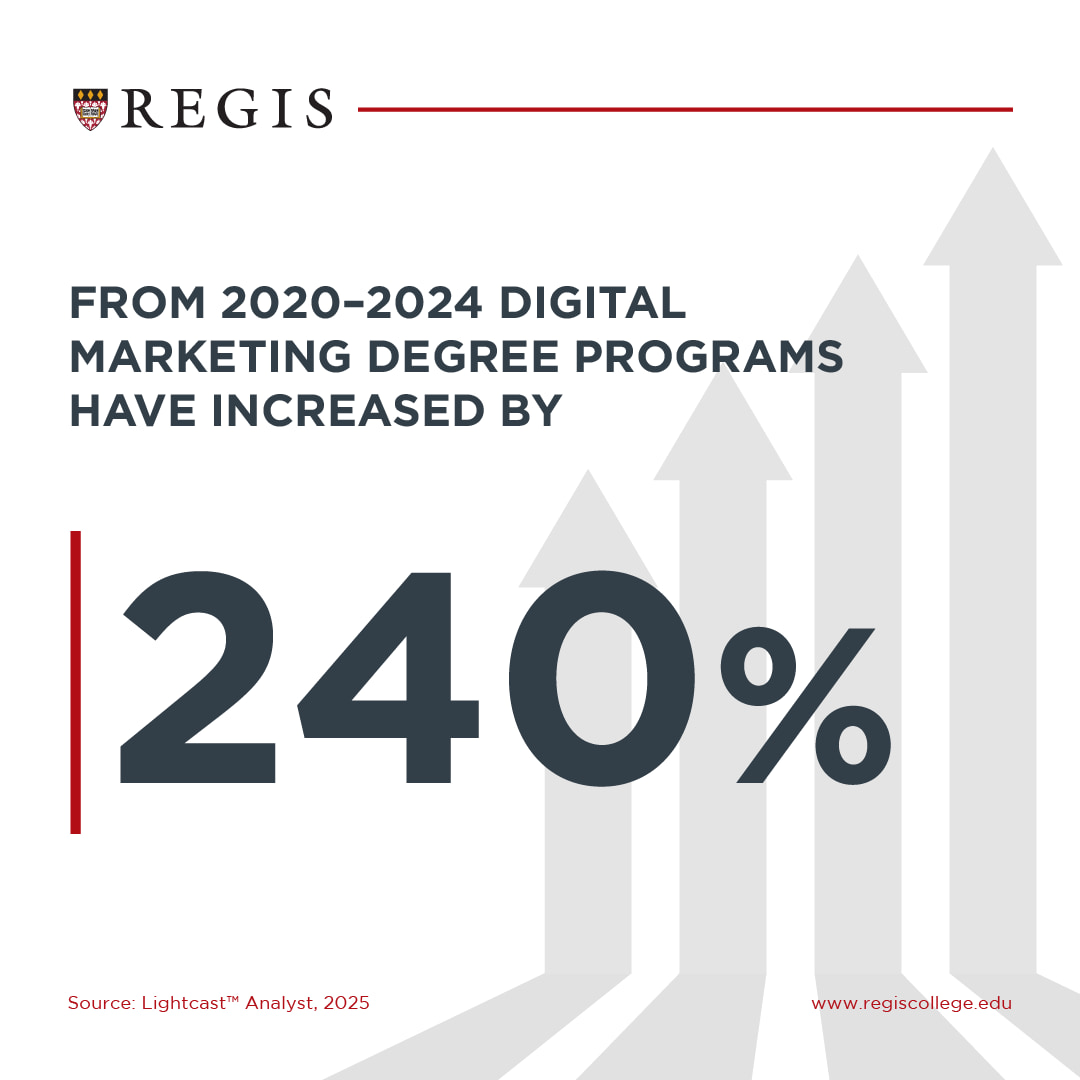

Image Source: regiscollege.edu

Another key strategy for success in 2025 is to develop a strong personal brand. In today’s digital world, having a strong personal brand can set you apart from the competition and help you attract new clients and opportunities. This may involve creating a professional website, engaging in thought leadership through blogging or social media, or networking with industry leaders both online and offline. By showcasing your expertise and unique perspective, you can position yourself as a leader in the field and attract new opportunities for growth and success.

In addition to educating yourself and developing a strong personal brand, it is also important to stay agile and adaptable in your approach to digital marketing. The industry is constantly changing, and what works today may not work tomorrow. By staying flexible and willing to experiment with new strategies and tactics, you can adapt to changing trends and ensure that your campaigns remain effective and successful in 2025 and beyond.

Collaboration is another key strategy for success in digital marketing. In today’s interconnected world, collaboration is essential for success. By working with other professionals, sharing insights and best practices, and collaborating on projects, you can tap into new ideas and perspectives that can help you stay ahead of the curve and achieve greater success in your digital marketing career.

Finally, it is important to prioritize creativity and innovation in your digital marketing efforts. With so much competition in the field, it is essential to stand out from the crowd and capture the attention of your target audience. By prioritizing creativity and innovation in your campaigns, you can create memorable and impactful experiences for your audience that drive results and set you apart from the competition.

In conclusion, the key to success in digital marketing in 2025 and beyond is to stay ahead of the curve by continually educating yourself, developing a strong personal brand, staying agile and adaptable, collaborating with others, and prioritizing creativity and innovation. By following these strategies, you can future-proof your digital marketing career and achieve success in the ever-evolving digital landscape.

Image Source: shivanipundir.com

How to Grow Your Digital Marketing Career in 2025

Image Source: cloudinary.com

Image Source: nexxadigital.com

Image Source: cloudinary.com

Image Source: twimg.com