Unlocking the Power of Influence

In today’s digital age, influencer marketing has become one of the most powerful tools for brands to reach their target audience. Influencers have the ability to sway the opinions and purchasing decisions of their followers, making them valuable partners for businesses looking to increase their brand awareness and drive sales. But how exactly can you unlock the power of influence and leverage it for your own brand’s success?

The first step in mastering the basics of influencer outreach is understanding the different types of influencers and how they can benefit your brand. There are three main categories of influencers: mega influencers, macro influencers, and micro influencers. Mega influencers have millions of followers and reach a wide audience, making them ideal for large-scale brand campaigns. Macro influencers have a smaller but still substantial following, and are great for reaching a more targeted audience. Micro influencers have a smaller following but often have higher engagement rates, making them ideal for niche markets.

Once you have identified the type of influencer that aligns with your brand’s goals, the next step is to build a relationship with them. Influencer outreach is all about forming authentic connections and partnerships with influencers who genuinely align with your brand values and target audience. When reaching out to influencers, it’s important to be genuine, respectful, and transparent about your intentions. Personalized messages that show you have done your research on the influencer and understand their content will go a long way in building a successful partnership.

When working with influencers, it’s crucial to give them creative freedom and trust their expertise. Influencers know their audience best, so it’s important to let them create content that resonates with their followers while also aligning with your brand’s messaging. Collaborating with influencers on creative campaigns can lead to authentic and engaging content that will drive positive results for your brand.

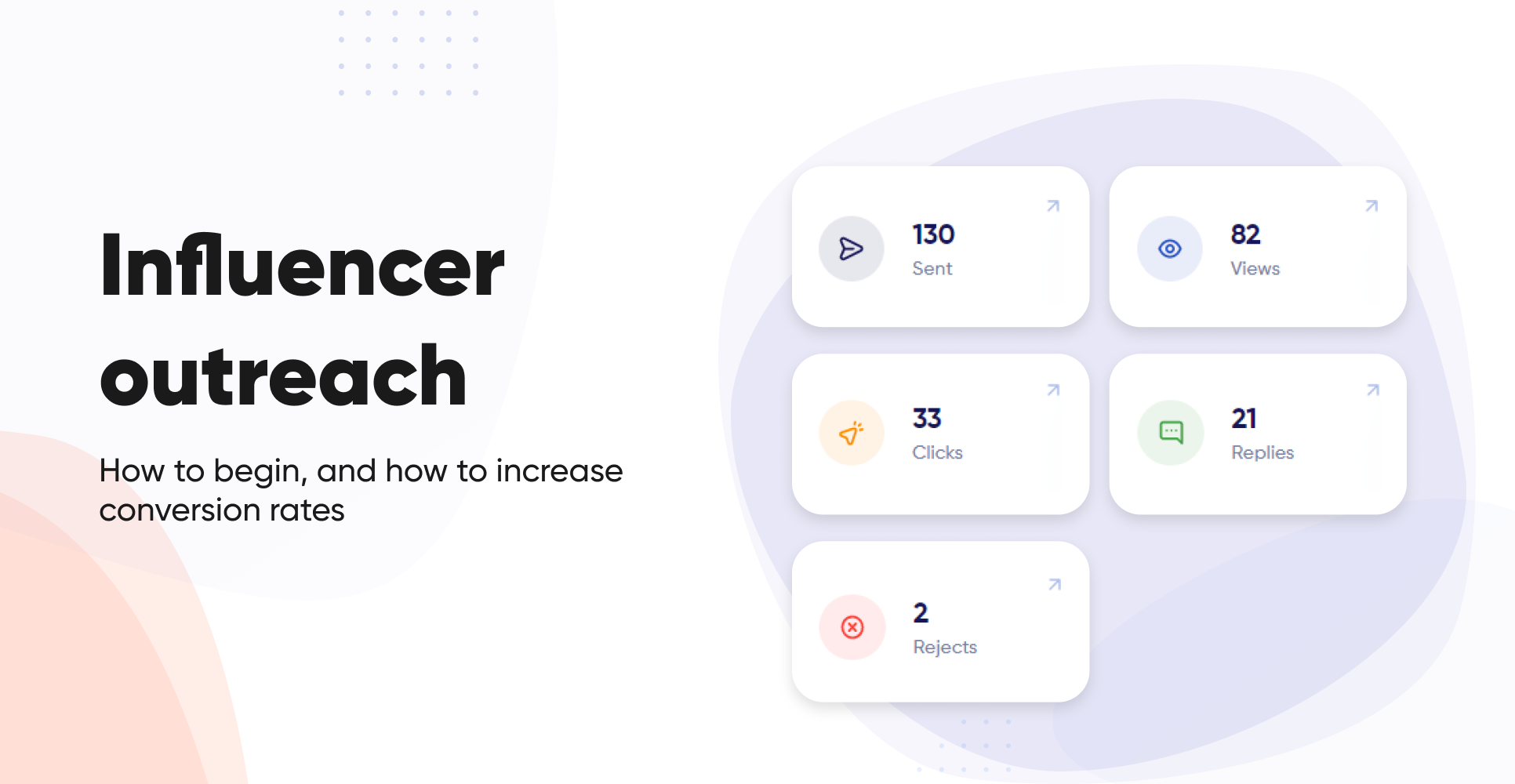

Image Source: socialbook.io

In addition to creating engaging content, it’s important to track and measure the success of your influencer campaigns. Utilizing analytics tools and tracking metrics such as reach, engagement, and conversions will help you understand the impact of your influencer partnerships and make data-driven decisions for future campaigns. By analyzing the performance of your influencer collaborations, you can optimize your strategies and ensure you are getting the most out of your partnerships.

In conclusion, unlocking the power of influence is all about building genuine connections with influencers, giving them creative freedom, and measuring the success of your campaigns. By mastering the basics of influencer outreach and leveraging the power of influence, you can reach new audiences, increase brand awareness, and drive sales for your business. So go ahead, unlock the power of influence and watch your brand soar to new heights!

Building Connections with Influencers

In today’s digital age, influencer outreach has become a crucial aspect of any successful marketing strategy. Building connections with influencers can help businesses reach a larger audience, increase brand visibility, and ultimately drive sales. However, for beginners looking to master the basics of influencer outreach, it can seem like a daunting task. But fear not, we’re here to guide you through the process and help you build valuable connections with influencers in your industry.

The first step in building connections with influencers is to identify the right ones for your brand. Take the time to research and find influencers who align with your brand values, target audience, and niche. Look for influencers who have a strong following, high engagement rates, and create content that resonates with your target market. By partnering with influencers that are a natural fit for your brand, you will be more likely to see success in your outreach efforts.

Once you have identified Potential influencers to work with, it’s time to reach out to them. Keep in mind that influencers receive numerous collaboration requests daily, so it’s important to stand out and make a good impression. Personalize your outreach message and show genuine interest in their work. Highlight why you believe they would be a great fit for your brand and how you envision working together. Building a relationship based on mutual respect and trust is key to successful influencer partnerships.

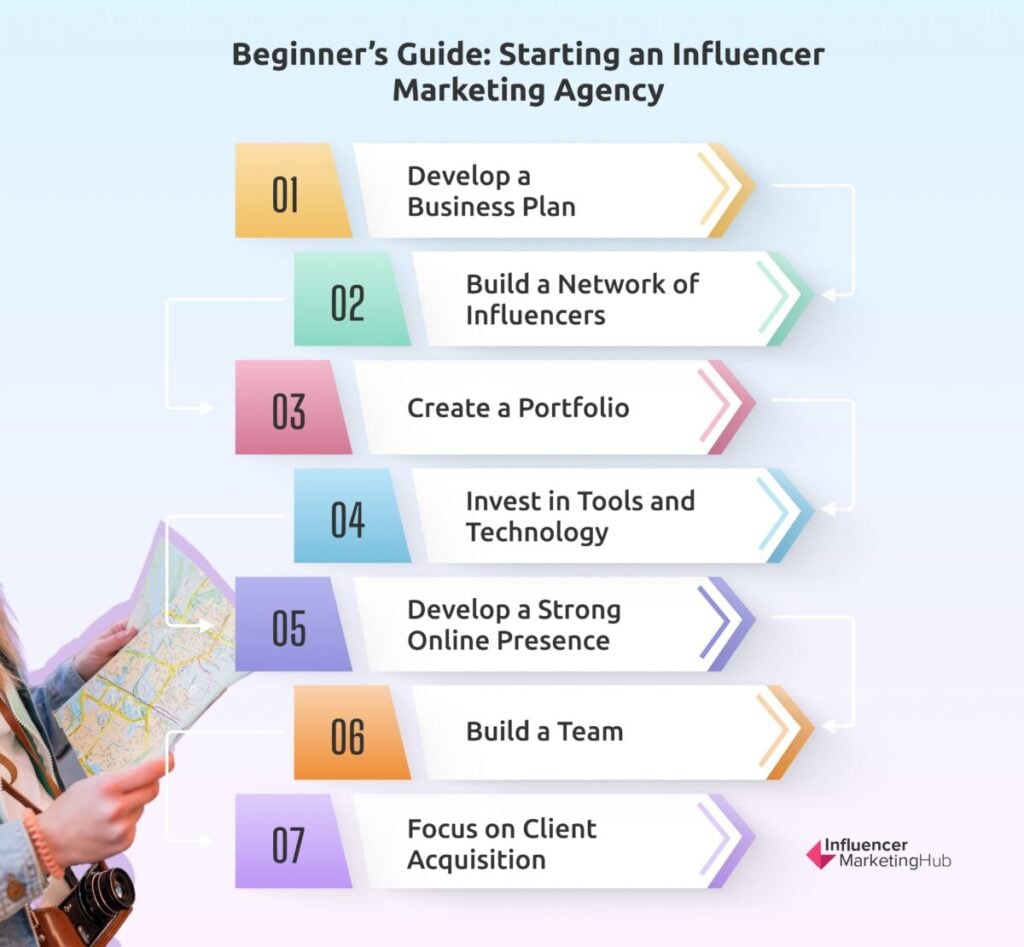

Image Source: influencermarketinghub.com

When reaching out to influencers, consider offering them something of value in exchange for their collaboration. This could be in the form of free products, exclusive discounts, or even monetary compensation. Remember that influencers put time and effort into creating content for brands, so it’s important to show appreciation for their work. By offering something of value, you are more likely to entice influencers to work with you and create authentic and engaging content for your brand.

Another important aspect of building connections with influencers is to engage with their content on social media. Like, comment, and share their posts to show your support and appreciation for their work. By actively engaging with influencers on social media, you can build rapport and establish a relationship with them. This will make it easier to approach them for collaboration opportunities in the future.

In addition to engaging with influencers on social media, consider attending industry events and networking opportunities where influencers may be present. Building connections in person can be a powerful way to establish relationships and create opportunities for collaboration. Take the time to introduce yourself, get to know influencers on a personal level, and discuss potential partnership opportunities. By building a strong network of influencers in your industry, you can expand your reach and increase brand visibility.

As you begin to build connections with influencers, it’s important to nurture these relationships and maintain open communication. Keep in touch with influencers regularly, provide them with updates about your brand, and show appreciation for their support. By building strong and lasting relationships with influencers, you can create long-term partnerships that are beneficial for both parties.

In conclusion, building connections with influencers is a key component of mastering the basics of influencer outreach. By identifying the right influencers, personalizing your outreach efforts, offering value, engaging with influencers on social media, attending networking events, and nurturing relationships, you can establish meaningful connections with influencers in your industry. Remember to approach influencer outreach with a positive attitude, genuine interest, and a willingness to build authentic relationships. By following these tips and strategies, you can successfully build connections with influencers and elevate your brand’s visibility and success.

Image Source: red-website-design.co.uk

Beginner’s Guide to Influencer Outreach

Image Source: red-website-design.co.uk

Image Source: ainfluencer.com

Image Source: trendhero.io