Mastering the Art of the Personal Brand Pitch

Crafting Your Personal Brand Pitch: Elevate Your Story in Just a Few Sentences

In today’s fast-paced and competitive world, it’s more important than ever to stand out from the crowd and make a lasting impression. One of the most effective ways to do this is by mastering the art of the personal brand pitch. Your personal brand pitch is a brief summary that highlights who you are, what you do, and why you are unique in just a few sentences. It’s a powerful tool that can help you make a strong first impression and leave a lasting impact on those you meet.

To craft a compelling personal brand pitch, you need to first understand yourself and what sets you apart from others. What are your strengths, skills, and values? What makes you unique and different from everyone else? By identifying these key elements, you can begin to build a pitch that accurately reflects who you are and what you have to offer.

Next, you need to think about your audience and what they are looking for. What problems do they have that you can solve? How can you add value to their lives or businesses? By tailoring your pitch to address the needs and concerns of your audience, you can make a stronger connection and leave a more lasting impression.

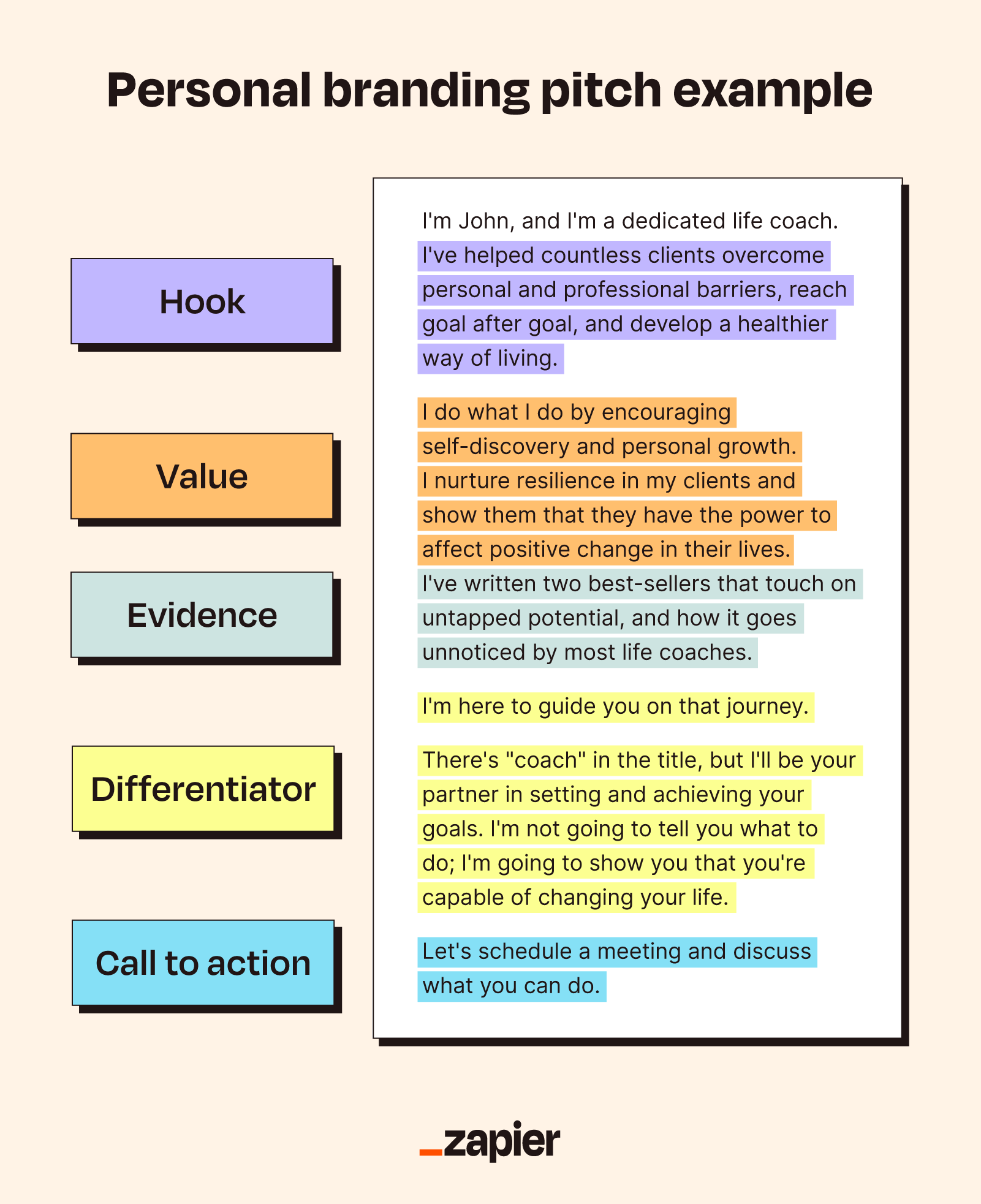

Image Source: ctfassets.net

When crafting your personal brand pitch, it’s important to keep it concise and to the point. You only have a few seconds to capture someone’s attention, so make every word count. Focus on the most important aspects of who you are and what you do, and be sure to highlight what makes you unique and special.

One way to elevate your story in just a few sentences is to use powerful language that evokes emotion and paints a vivid picture. Instead of simply listing your skills and qualifications, try to tell a story that showcases your passion, drive, and ambition. Use descriptive language that brings your pitch to life and makes it memorable.

Another important aspect of mastering the art of the personal brand pitch is to practice, practice, practice. The more you rehearse your pitch, the more confident and natural you will become when delivering it. Try practicing in front of a Mirror, with friends or family, or even record yourself and listen back to see where you can improve.

In addition to practicing your pitch, it’s also important to be adaptable and flexible. Every situation is different, and you may need to adjust your pitch depending on who you are talking to or the context of the conversation. By being able to tailor your pitch on the fly, you can make a stronger impact and leave a more lasting impression.

Finally, don’t forget to follow up after delivering your personal brand pitch. Send a thank you note or email, connect on social media, or schedule a follow-up meeting to continue the conversation. Building relationships and making connections is key to success, and following up shows that you are serious and committed to building those connections.

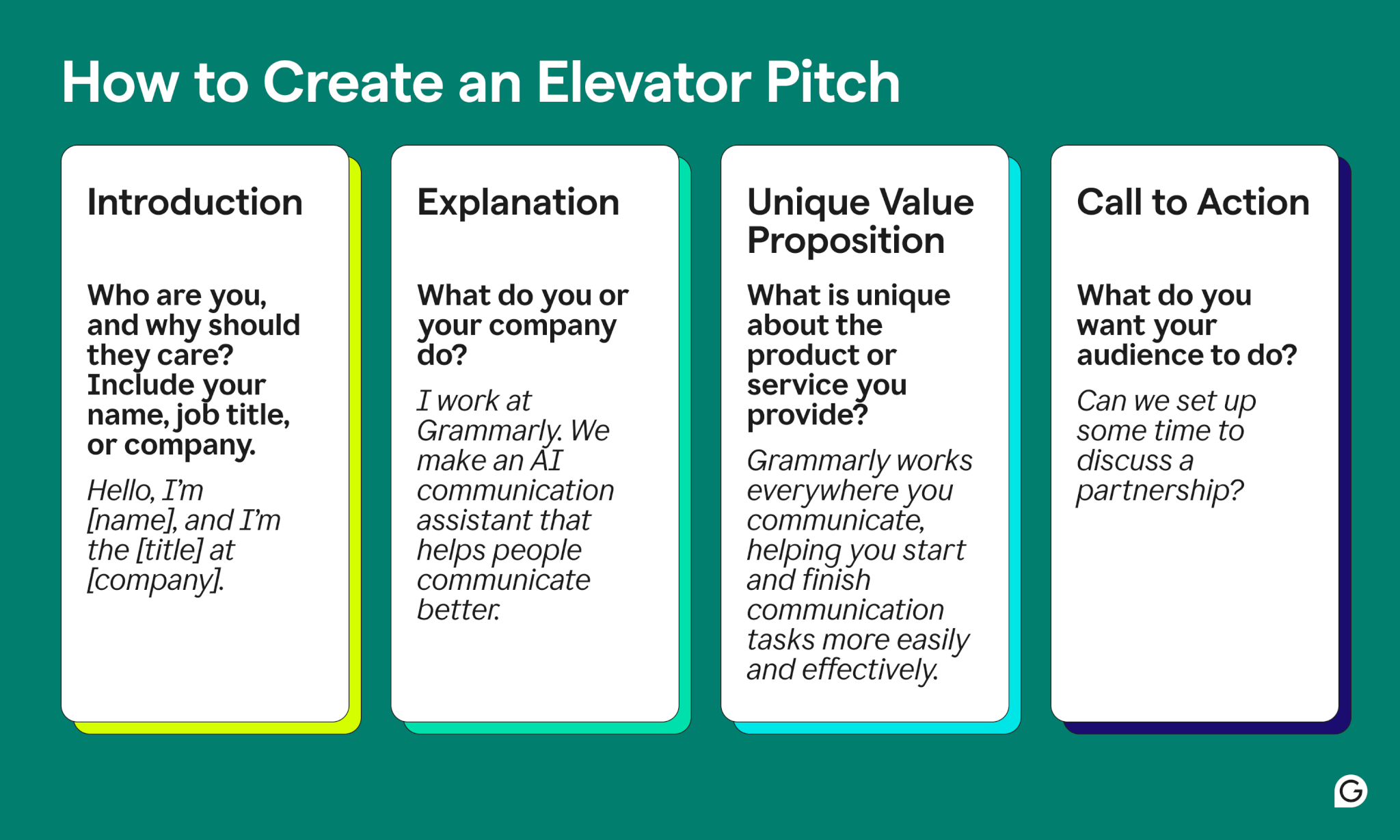

Image Source: grammarly.com

In conclusion, mastering the art of the personal brand pitch is a powerful tool that can help you stand out from the crowd and make a lasting impression. By understanding yourself, tailoring your pitch to your audience, using powerful language, practicing, being adaptable, and following up, you can elevate your story in just a few sentences and leave a lasting impact on those you meet. So start crafting your personal brand pitch today and watch as opportunities start to unfold.

Elevate Your Story Like a Pro in Just a Few Sentences

Crafting a personal brand pitch is essential in today’s competitive job market and business world. Your ability to succinctly communicate who you are and what you bring to the table can make all the difference in landing your dream job or attracting your ideal clients. In just a few sentences, you have the opportunity to showcase your unique talents, experiences, and values in a way that leaves a lasting impression on others.

To elevate your story like a pro, you need to first understand what sets you apart from the rest. What makes you unique? What are your strengths and passions? What experiences have shaped you into the person you are today? By taking the time to reflect on these questions, you can begin to craft a personal brand pitch that truly represents who you are and what you stand for.

Next, think about the message you want to convey to your audience. What do you want them to know about you? What do you want them to remember after they have met you or read your pitch? Your story should be authentic, engaging, and memorable. It should leave a lasting impression on those who hear it, making them want to learn more about you and what you have to offer.

When crafting your personal brand pitch, it’s important to be concise and to the point. You only have a few sentences to make an impact, so make every word count. Avoid using jargon or industry-specific language that may confuse or alienate your audience. Instead, focus on clear, simple language that conveys your message effectively.

Image Source: ytimg.com

One effective strategy for crafting a powerful personal brand pitch is to use the who, what, why framework. Start by introducing yourself with a brief statement of who you are and what you do. For example, I am a passionate digital marketer with a background in social media management. Next, explain what sets you apart from others in your field. This could be your unique approach to problem-solving, your innovative ideas, or your commitment to constant learning and growth. Finally, articulate why you do what you do and why it matters to you. This could be your desire to make a positive impact on the world, your love for connecting with others, or your dedication to excellence in everything you do.

Remember, your personal brand pitch should be a reflection of your authentic self. Don’t try to be someone you’re not or to mimic what you think others want to hear. Instead, focus on what makes you truly unique and special. Embrace your quirks, your passions, and your values, and let them shine through in your pitch.

In conclusion, crafting a personal brand pitch that elevates your story like a pro in just a few sentences requires introspection, clarity, and authenticity. By taking the time to reflect on what makes you unique, defining the message you want to convey, and using clear, concise language, you can create a pitch that leaves a lasting impression on others. So go ahead, elevate your story like a pro and watch as new opportunities and connections come your way.

Creating an Elevator Pitch for Your Personal Brand

Image Source: ctfassets.net

![image.title Elevator Pitch Examples (+Foolproof Pitch Template) [] • Asana image.title Elevator Pitch Examples (+Foolproof Pitch Template) [] • Asana](https://assets.asana.biz/transform/8d49c853-8f0f-4435-841f-9a9bdb34379c/inline-marketing-elevator-pitch-examples-4-2x)

Image Source: asana.biz

![image.title Elevator Pitch Examples (+Foolproof Pitch Template) [] • Asana image.title Elevator Pitch Examples (+Foolproof Pitch Template) [] • Asana](https://assets.asana.biz/transform/054f456a-4216-4a8f-b43d-5066fbe2b57c/inline-marketing-elevator-pitch-examples-3-2x)

Image Source: asana.biz

Image Source: cakeresume.com