Unleash Your Creativity: The Best Resume Builders for Designers

Are you a designer looking to craft the perfect CV that showcases your creativity and talent? Look no further, as we have compiled a list of the best resume builders specifically tailored for designers like you. These tools will not only help you create a visually appealing resume but also highlight your skills and experience in a way that sets you apart from the competition.

When it comes to designing a resume for a creative field, traditional temPlates and formats may not always cut it. That’s where these resume builders come in handy, offering a range of customizable options to help you unleash your creativity and make a lasting impression on Potential employers.

One of the top resume builders for designers is Canva. Known for its user-friendly interface and vast selection of design elements, Canva allows you to easily create a visually stunning resume that reflects your unique style. From choosing the perfect color scheme to adding graphics and icons, Canva offers endless possibilities for customization.

Another popular option for designers is Adobe Spark. With its intuitive design tools and professional templates, Adobe Spark empowers you to craft a standout CV that showcases your design skills. Whether you’re a graphic designer, web designer, or illustrator, Adobe Spark has everything you need to create a resume that speaks to your creative abilities.

Image Source: cloudfront.net

For those looking for a more minimalist approach, Figma is a great choice. Figma’s sleek and modern templates are perfect for designers who prefer a clean and simple aesthetic. With Figma, you can easily customize fonts, colors, and layouts to create a professional yet stylish resume that highlights your design expertise.

If you’re looking to go the extra mile and create a truly unique resume, look no further than Visme. Visme offers a wide range of design tools and features, allowing you to create interactive and visually engaging resumes that are sure to impress recruiters. With Visme, you can add animations, interactive charts, and multimedia elements to take your resume to the next level.

Last but not least, Piktochart is another great option for designers who want to showcase their creativity in their CV. Piktochart’s drag-and-drop interface makes it easy to create eye-catching resumes with custom graphics and illustrations. Whether you’re a seasoned designer or just starting out, Piktochart offers a range of templates and design tools to help you create a resume that stands out.

In conclusion, the key to crafting the perfect CV as a designer is to unleash your creativity and showcase your unique style. With the help of these top resume builders, you can create a standout resume that not only highlights your skills and experience but also reflects your passion for design. So why wait? Start building your perfect CV today and take your career to new heights!

Craft the Perfect CV with These Top Tools and Stand Out!

Are you a designer looking to showcase your creativity and stand out from the crowd with a top-notch resume? Look no further! We have compiled a list of the best resume builders that will help you craft the perfect CV to showcase your skills and experience in the most visually appealing way possible.

Image Source: cloudfront.net

1. Canva: Canva is a popular graphic design tool that offers a wide range of temPlates specifically designed for resumes. With Canva, you can easily customize your CV by choosing from a variety of fonts, colors, and layouts. You can also add graphics and images to make your resume visually appealing and unique. Canva is user-friendly and intuitive, making it a great choice for designers who want to create a standout resume quickly and easily.

2. Adobe Spark: Adobe Spark is another great tool for designing visually appealing resumes. With Adobe Spark, you can choose from a variety of professional templates and customize them to fit your personal style. You can easily add images, text, and graphics to make your resume stand out. Adobe Spark also offers collaboration features, so you can easily work with others to create the perfect CV.

3. Visme: Visme is a versaTile design tool that offers a range of templates for resumes. With Visme, you can create interactive resumes that include videos, animations, and other multimedia elements. You can also customize your resume with your own branding and style. Visme is a great choice for designers who want to create a resume that showcases their creativity in a unique and engaging way.

4. Resumonk: Resumonk is a simple and easy-to-use resume builder that offers a variety of templates for designers. With Resumonk, you can create a professional-looking CV in minutes by simply filling in your information and choosing a template. Resumonk also offers customization options, so you can easily tailor your resume to fit your personal style. Resumonk is a great choice for designers who want a straightforward and hassle-free way to create a standout resume.

5. VisualCV: VisualCV is a popular resume builder that offers a range of templates for designers. With VisualCV, you can create a visually appealing CV that highlights your skills and experience. You can easily customize your resume by choosing from a variety of fonts, colors, and layouts. VisualCV also offers analytics tools, so you can track how many times your resume has been viewed and downloaded. VisualCV is a great choice for designers who want to create a resume that is both visually appealing and informative.

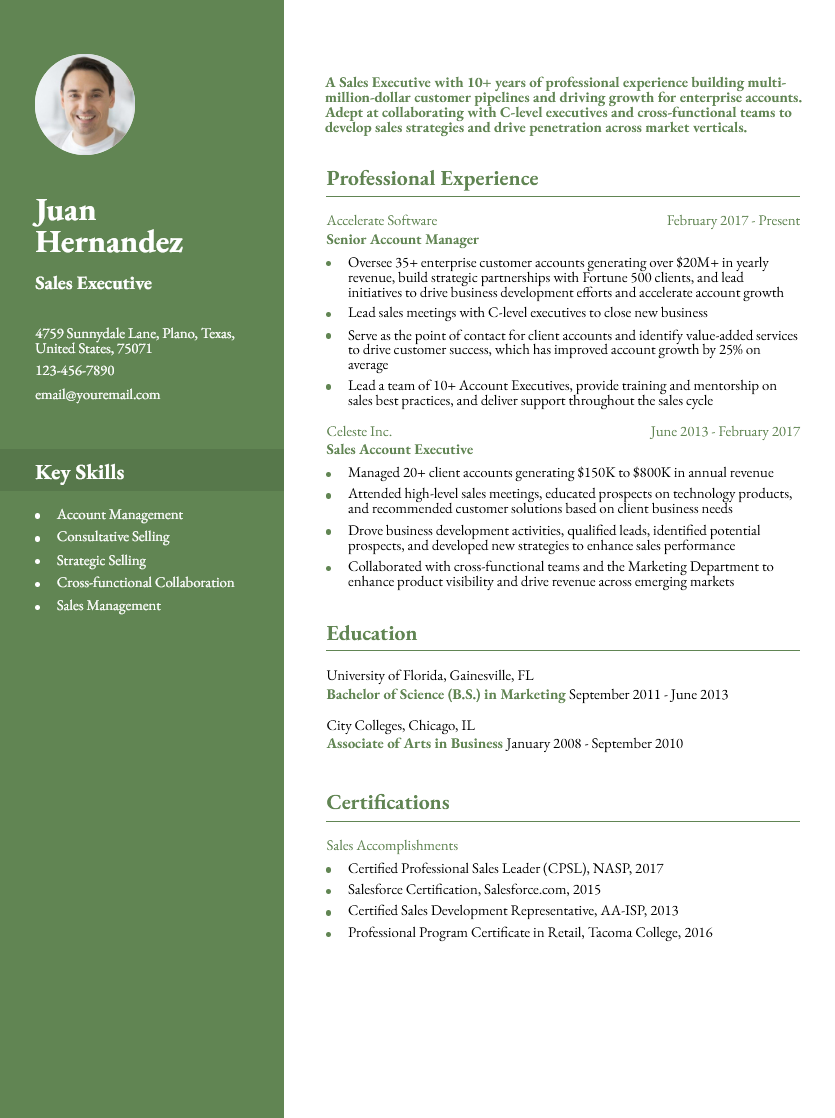

Image Source: resumebuilder.com

In conclusion, these top resume builders are great tools for designers who want to craft the perfect CV to showcase their creativity and stand out from the competition. Whether you prefer a simple and straightforward design or a more interactive and multimedia-rich resume, there is a tool on this list that will meet your needs. So why wait? Start creating your standout resume today and land your dream job!

Best Resume Builders for Designers

Image Source: cloudfront.net

Image Source: novoresume.com

Image Source: amazonaws.com