Mastering Stress: A Creative Professional’s Guide

Stress is a common experience for many creative professionals. The pressure to constantly come up with new ideas, meet tight deadlines, and deliver exceptional work can take a toll on both mental and physical well-being. However, with the right tools and strategies, it is possible to master stress and thrive in a demanding industry.

As a creative professional, it is essential to prioritize self-care and stress management in order to maintain a healthy work-life balance. Here are some tips to help you navigate the challenges of stress and unleash your creativity:

1. Practice Mindfulness: One of the most effective ways to Combat stress is through mindfulness. By staying present in the moment and focusing on your breathing, you can reduce anxiety and improve your overall sense of well-being. Consider incorporating mindfulness exercises into your daily routine, such as meditation or yoga, to help calm your mind and increase your creativity.

2. Set Boundaries: As a creative professional, it can be easy to blur the lines between work and personal life. However, it is important to set boundaries and prioritize self-care. Make sure to designate specific times for work and relaxation, and avoid checking emails or working outside of these hours. By setting boundaries, you can prevent burnout and maintain a healthy work-life balance.

:max_bytes(150000):strip_icc()/3145195-article-tips-to-reduce-stress-5a8c75818e1b6e0036533c47.png)

Image Source: verywellmind.com

3. Take Breaks: When working on a creative project, it can be tempting to work long hours without taking breaks. However, this can lead to burnout and decreased productivity. Make sure to schedule regular breaks throughout your day to rest and recharge. This can help improve your focus and creativity when you return to work.

4. Get Moving: Physical activity is a great way to reduce stress and improve your overall well-being. Consider incorporating exercise into your daily routine, whether it’s going for a walk, practicing yoga, or hitting the gym. Exercise releases endorphins, which can help elevate your mood and increase your creativity.

5. Connect with Others: As a creative professional, it is important to have a strong support network. Reach out to friends, family, or colleagues for support during times of stress. Connecting with others can help you feel less isolated and provide a fresh perspective on your creative projects.

6. Practice Gratitude: Take a moment each day to reflect on the things you are grateful for. Practicing gratitude can help shift your focus from stress to positivity, and improve your overall outlook on life. Consider keeping a gratitude journal to write down three things you are thankful for each day.

7. Seek Help: If you are feeling overwhelmed by stress, don’t be afraid to seek help. Consider speaking to a therapist or counselor to help you develop coping strategies and manage your stress effectively. Remember, it is okay to ask for help when you need it.

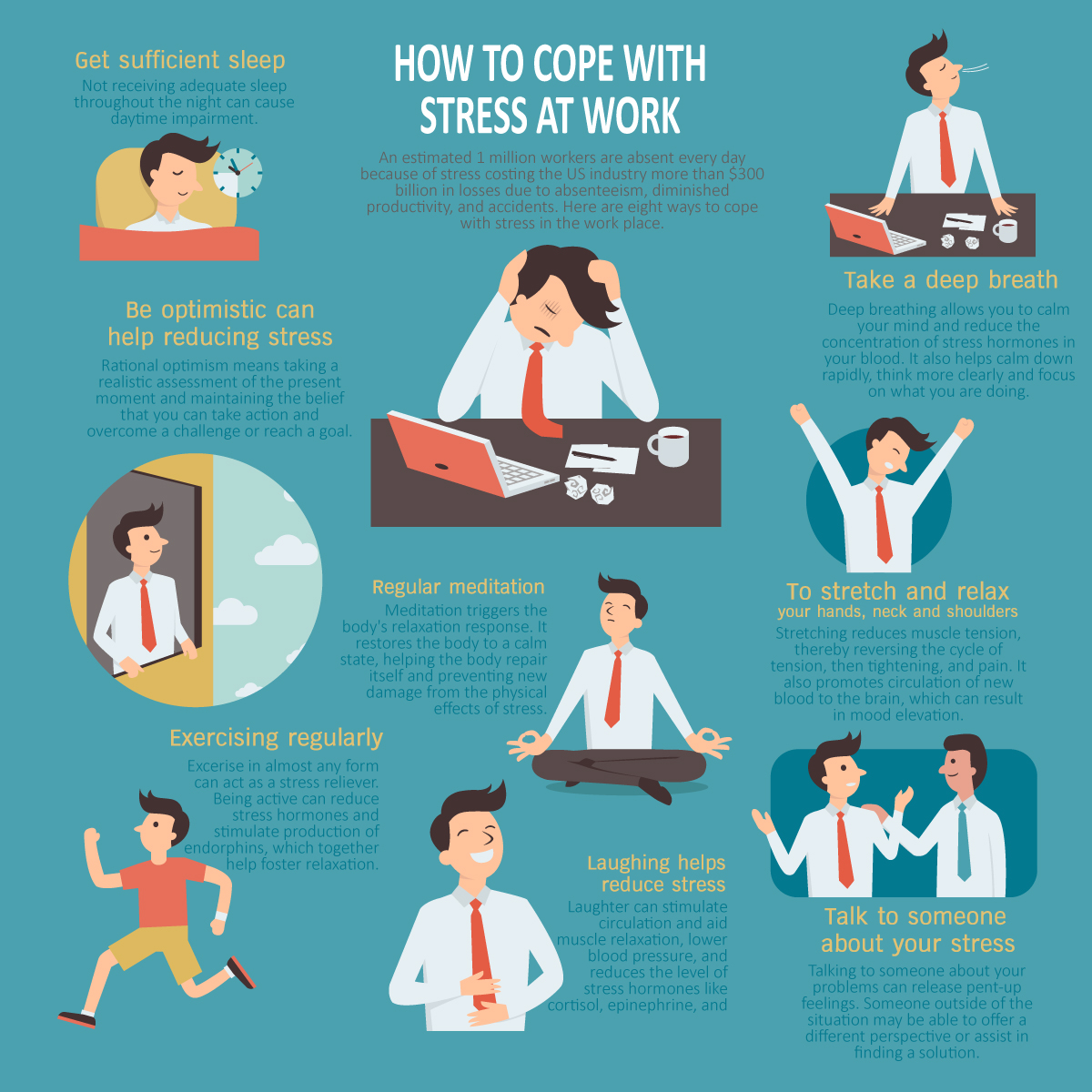

Image Source: licdn.com

By incorporating these tips into your daily routine, you can master stress and unleash your creativity as a creative professional. Prioritizing self-care and stress management is essential for maintaining a healthy work-life balance and thriving in a demanding industry. Remember to take care of yourself and prioritize your well-being as you navigate the challenges of stress in your creative career.

Unleash Your Creativity with These Stress Tips

Stress is a common enemy of creative professionals. The pressure to constantly produce innovative work, meet deadlines, and exceed expectations can take a toll on both mental and physical health. However, stress doesn’t have to stifle your creativity. In fact, with the right tools and techniques, you can use stress to fuel your creative fire. Here are some tips to help you unleash your creativity and manage stress like a pro.

1. Embrace Mindfulness

One of the most effective ways to manage stress and boost creativity is to practice mindfulness. Mindfulness involves being fully present in the moment and nonjudgmentally acknowledging your thoughts and feelings. By taking a few moments each day to practice mindfulness, you can reduce stress levels, increase focus, and tap into your creative Potential.

2. Take Breaks

:max_bytes(150000):strip_icc()/how-to-reduce-stress-5207327_FINAL-907db114a640431ba1e8ecbb9e81b77f.jpg)

Image Source: verywellhealth.com

As a creative professional, it’s easy to get caught up in your work and forget to take breaks. However, taking regular breaks is essential for maintaining productivity and managing stress. Schedule short breaks throughout your day to rest your mind, stretch your body, and recharge your creative energy.

3. Get Moving

Physical activity is a powerful stress reliever and creativity booster. Whether you prefer to go for a run, practice yoga, or take a dance class, getting your body moving can help release tension, clear your mind, and stimulate creative thinking. Make time for regular exercise to keep stress at bay and keep your creative juices flowing.

4. Connect with Nature

Spending time in nature is a great way to reduce stress and spark creativity. Take a walk in the park, go for a hike, or simply sit outside and soak up the sights and sounds of the natural world. Connecting with nature can help you gain perspective, find inspiration, and rejuvenate your creative spirit.

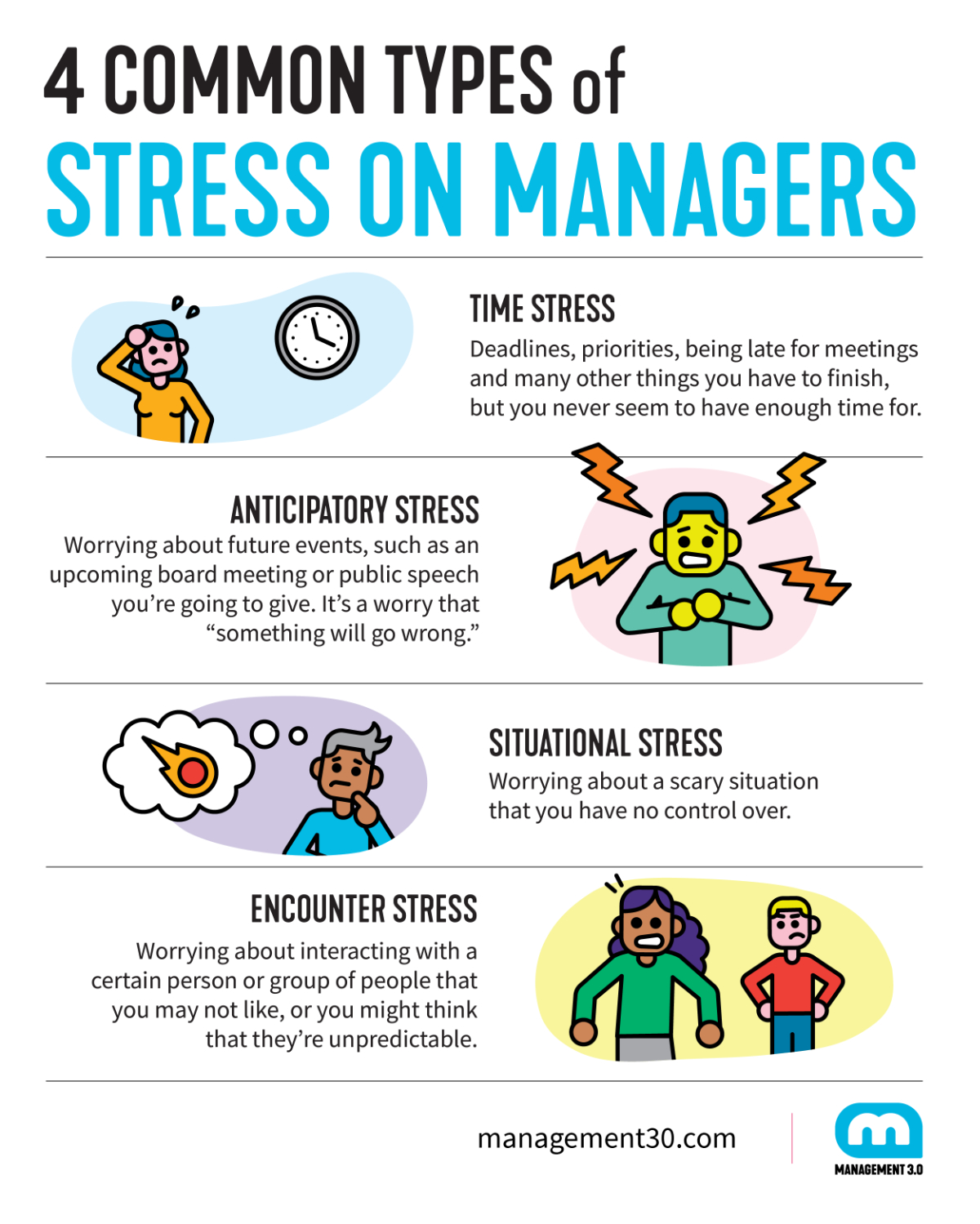

Image Source: management30.com

5. Practice Self-Care

Self-care is essential for managing stress and maintaining a healthy work-life balance. Make time for activities that nourish your mind, body, and soul, such as reading a good book, taking a Bubble Bath, or indulging in a hobby you love. Prioritizing self-care will not only help you manage stress but also boost your creativity and overall well-being.

6. Experiment with Different Creative Outlets

Sometimes, the best way to Combat stress and ignite creativity is to try something new. Experiment with different creative outlets, such as Painting, writing, photography, or cooking, to stimulate your imagination and break out of a creative rut. By exploring new forms of expression, you can discover fresh perspectives and unlock hidden talents.

7. Seek Support

Image Source: feea.org

Don’t be afraid to reach out for support when you’re feeling overwhelmed. Whether you talk to a trusted friend, family member, or therapist, sharing your feelings and seeking guidance can help you gain clarity, find solutions, and reduce stress. Remember, it’s okay to ask for help when you need it.

8. Set Boundaries

As a creative professional, it’s important to set boundaries to protect your time, energy, and creativity. Learn to say no to projects that don’t align with your values or goals, delegate tasks when necessary, and prioritize your well-being above all else. By setting boundaries, you can create a healthy work environment that fosters creativity and minimizes stress.

In conclusion, managing stress as a creative professional is all about finding balance, practicing self-care, and tapping into your creative potential. By incorporating these tips into your daily routine, you can unleash your creativity, boost productivity, and thrive in your creative endeavors. Remember to prioritize your well-being, listen to your intuition, and embrace the journey of self-discovery. With a little mindfulness and a lot of creativity, you can conquer stress and create your best work yet.

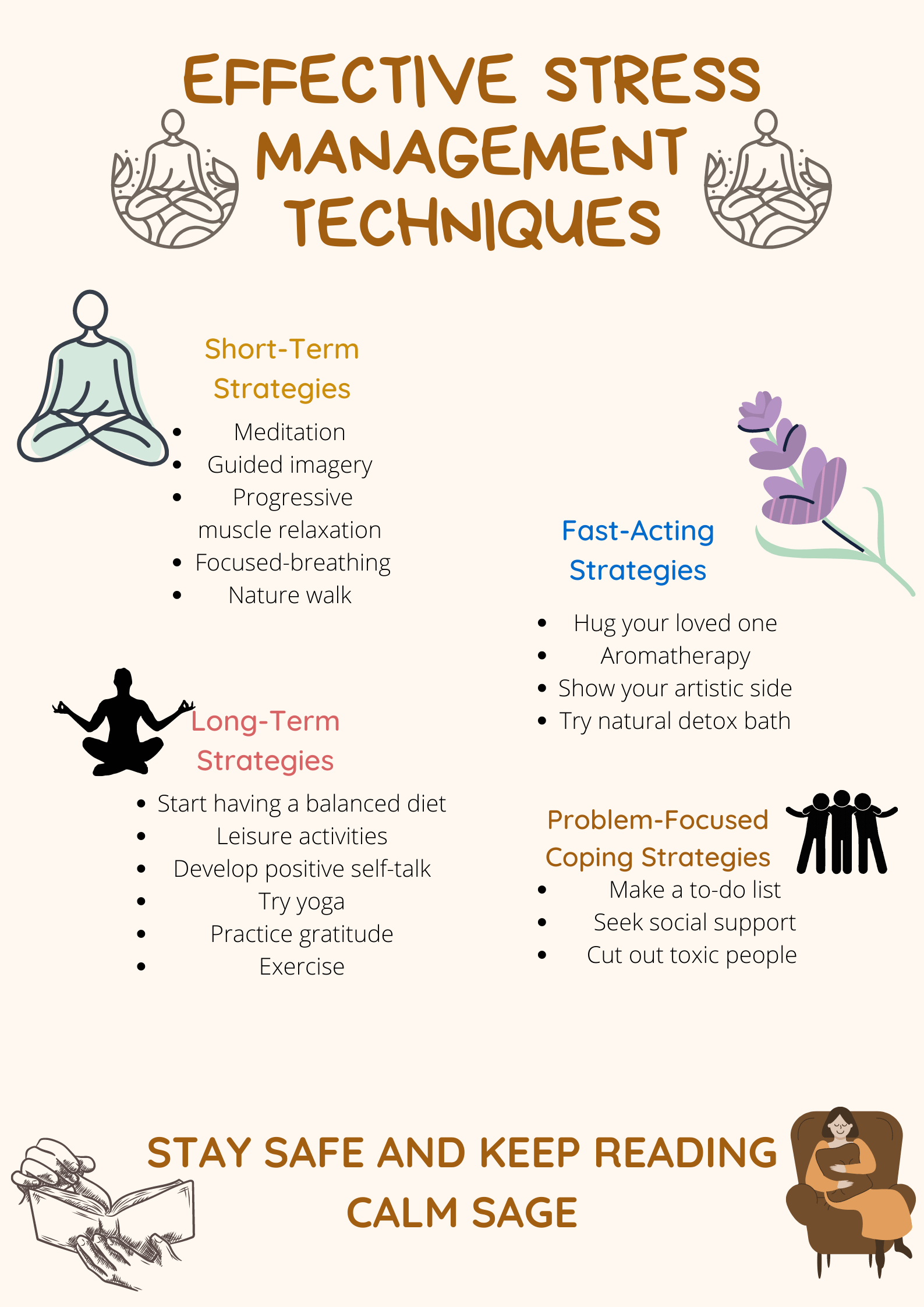

Image Source: calmsage.com

How to Manage Stress as a Creative Professional

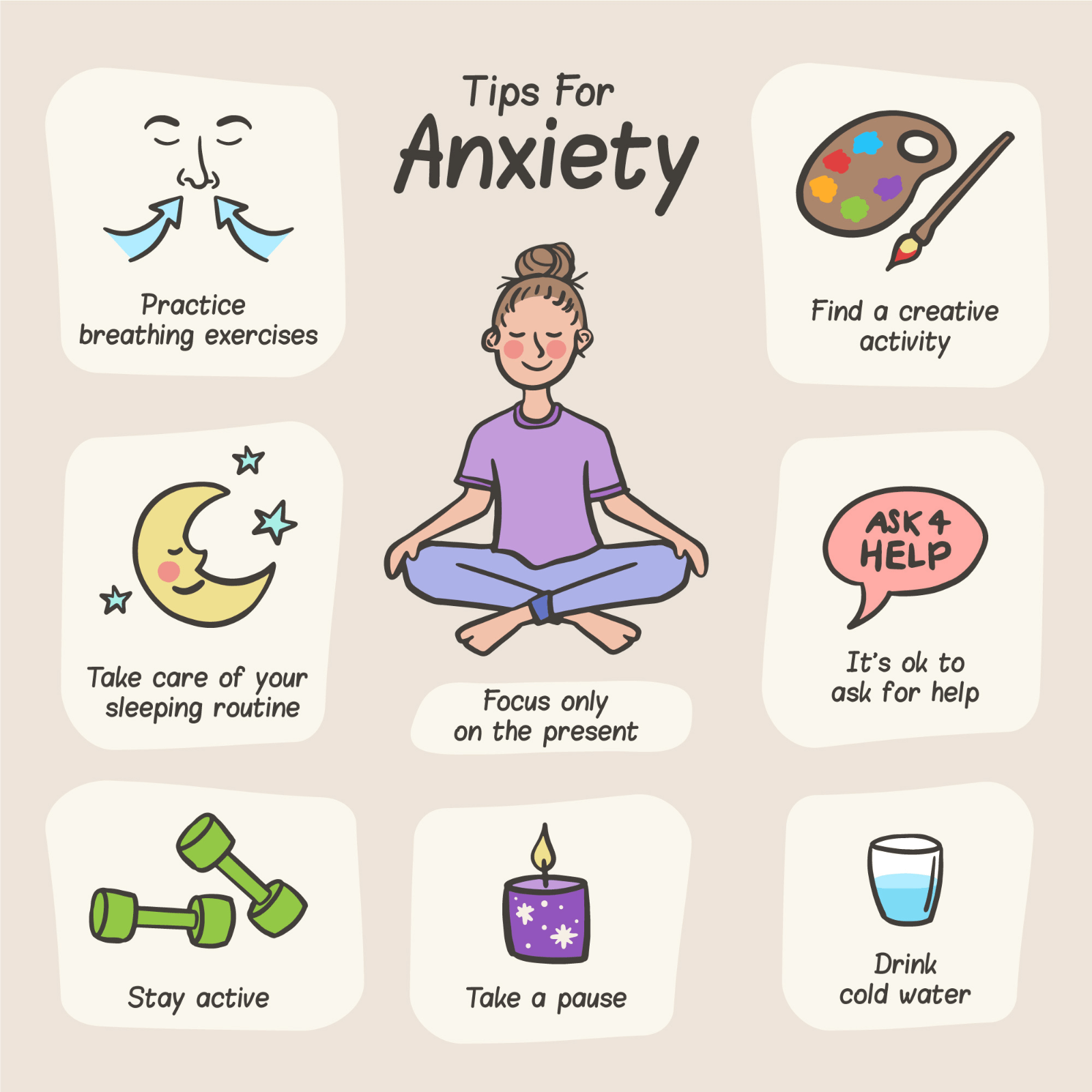

Image Source: calmclinic.com

Image Source: amazonaws.com