Unleash Your True Potential

In a world filled with constant pressure to conform and fit in, it can be easy to lose sight of who we truly are. We often find ourselves wearing masks to please others, hiding our true selves in fear of rejection or judgment. However, embracing our authenticity and unleashing our true potential is essential not only for personal growth but also for successful branding.

When we embrace our true selves, we unlock a world of possibilities. Our unique talents, quirks, and perspectives are what set us apart from the crowd and make us stand out. By embracing our authenticity, we can tap into our true potential and harness our strengths to achieve our goals and dreams.

In branding, authenticity is a powerful tool that can set a company apart from its competitors. Consumers are drawn to brands that are genuine and true to themselves. When a brand stays true to its values and beliefs, it creates a sense of trust and loyalty among its customers.

By unleashing our true potential and embracing authenticity in branding, we can create a powerful connection with our audience. People are drawn to authenticity because it is relatable and genuine. When a brand is authentic, it creates a sense of transparency and honesty that resonates with consumers.

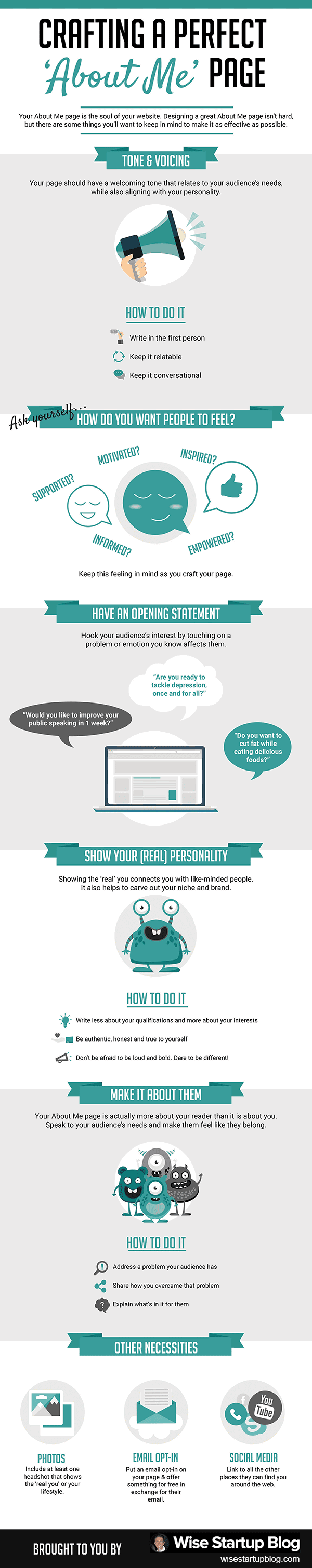

Image Source: medium.com

One of the key aspects of unleashing our true potential is self-awareness. By taking the time to reflect on our values, beliefs, and strengths, we can better understand who we are and what sets us apart from others. This self-awareness allows us to embrace our authenticity and showcase our true selves to the world.

In branding, self-awareness is equally important. A brand must understand its unique selling points, values, and identity in order to effectively communicate with its audience. By staying true to itself and embracing authenticity, a brand can create a strong and lasting connection with its customers.

When we unleash our true potential and embrace authenticity in branding, we create a sense of empowerment and confidence within ourselves. By being true to who we are, we can overcome challenges, push past limitations, and achieve our goals with passion and determination.

Authenticity is a powerful force that can propel us forward in both our personal and professional lives. When we embrace our true selves and stay true to our values, we create a sense of purpose and clarity that guides us on our journey to success.

So, let us all take a moment to reflect on our true potential and embrace the power of authenticity in branding. By being true to ourselves, we can unlock a world of possibilities and create a lasting impact on those around us. Embrace your authenticity, unleash your true potential, and watch as you soar to new heights of success.

Embrace Authenticity in Branding

Image Source: squarespace-cdn.com

In today’s fast-paced and competitive world, branding has become more important than ever. With countless companies vying for consumers’ attention, it can be challenging to stand out from the crowd. However, one surefire way to make a lasting impression is by embracing authenticity in branding.

Authenticity is a powerful tool that can help you connect with your target audience on a deeper level. When you are true to yourself and your brand values, you build trust and credibility with your customers. People are more likely to do business with a company that they perceive as genuine and honest.

But what exactly does it mean to embrace authenticity in branding? It means being true to who you are as a company and as a brand. It means staying true to your values, your mission, and your unique voice. It means not trying to be something you’re not just to fit in or appeal to a wider audience.

When you embrace authenticity in branding, you are able to differentiate yourself from your competitors. You have something that sets you apart and makes you memorable. Whether it’s your commitment to sustainability, your focus on quality craftsmanship, or your quirky sense of humor, your authenticity shines through and draws people in.

Authenticity also allows you to build a more loyal customer base. When people feel a genuine connection to your brand, they are more likely to become repeat customers and brand advocates. They will recommend your products or services to their friends and family, helping you grow your business organically.

Image Source: martech.zone

In a world where consumers are bombarded with marketing messages and advertisements at every turn, authenticity is like a breath of fresh air. People are tired of being sold to constantly. They crave real connections and genuine interactions. By embracing authenticity in branding, you can cut through the noise and create genuine relationships with your customers.

Furthermore, authenticity can help you weather any storms that come your way. In times of crisis or controversy, companies that have built a strong foundation of authenticity are better equipped to handle the situation. When you have been honest and transparent with your customers from the beginning, they are more likely to forgive any missteps and continue to support you.

So how can you embrace authenticity in branding? Start by defining your brand values and mission. What do you stand for? What sets you apart from your competitors? Once you have a clear understanding of who you are as a company, make sure that your branding reflects that.

Use your unique voice in all of your marketing materials, from your website copy to your social media posts. Be consistent in your messaging and imagery so that people can easily recognize your brand. Show the human side of your company by sharing behind-the-scenes glimpses and stories about your team.

Above all, be honest and transparent with your customers. If you make a mistake, own up to it and make it right. People will respect you more for being authentic and taking responsibility for your actions.

Image Source: honeybook.com

In conclusion, embracing authenticity in branding is essential for building a strong and successful business. By staying true to yourself and your brand values, you can connect with your target audience on a deeper level, differentiate yourself from your competitors, build a loyal customer base, and weather any storms that come your way. So go ahead, embrace authenticity in branding and watch your business thrive.

Why Authenticity Is Key in Branding Yourself

Image Source: rallyrecruitmentmarketing.com

Image Source: renatwilliams.com

Image Source: webflow.com

Image Source: kelseyannedesign.com