Finding Harmony: Secrets to Balancing Work and Life

As a freelance designer, finding harmony between work and life can be a challenging task. With deadlines looming, clients demanding your attention, and a never-ending to-do list, it’s easy to feel overwhelmed and burnt out. However, it is possible to achieve a balanced life as a freelance designer with the right strategies in place. In this article, we will explore some secrets to balancing work and life as a freelance designer.

One of the first steps to finding harmony in your life as a freelance designer is to set boundaries. It’s important to establish clear boundaries between your work life and personal life. This means defining specific work hours and sticking to them, as well as creating designated workspaces in your home. By setting boundaries, you can prevent work from spilling over into your personal time, allowing you to truly unwind and recharge.

Another secret to balancing work and life as a freelance designer is to prioritize self-care. It’s easy to neglect self-care when you’re busy with work, but taking care of yourself is essential for maintaining a healthy work-life balance. Whether it’s getting enough sleep, eating well, exercising regularly, or practicing mindfulness, make self-care a priority in your daily routine. By taking care of yourself, you’ll be better equipped to handle the demands of freelancing.

In addition to setting boundaries and prioritizing self-care, another secret to finding harmony as a freelance designer is to delegate tasks when necessary. As a freelancer, it can be tempting to try to do everything yourself, but this can lead to burnout and overwhelm. Learning to delegate tasks to others, whether it’s hiring an assistant, outsourcing work, or automating certain processes, can help you free up time and mental energy to focus on what truly matters.

Image Source: mocktheagency.com

Furthermore, it’s important to cultivate a support system as a freelance designer. Freelancing can be a lonely endeavor, but having a support system in place can make a world of difference. Whether it’s connecting with other freelancers online, joining a co-working space, or seeking mentorship from more experienced designers, having a support system can provide you with encouragement, advice, and camaraderie.

Another key to finding harmony as a freelance designer is to practice time management and productivity techniques. With so many tasks to juggle as a freelancer, it’s important to be organized and efficient with your time. Whether it’s using project management tools, setting daily goals, or implementing the Pomodoro technique, finding time management and productivity techniques that work for you can help you stay on track and avoid feeling overwhelmed.

Lastly, finding harmony as a freelance designer also requires you to learn to say no. It can be tempting to take on every opportunity that comes your way, but overcommitting yourself can lead to stress and burnout. Learning to say no to projects or opportunities that don’t align with your goals or values is essential for maintaining a healthy work-life balance. By being selective about the work you take on, you can ensure that you have the time and energy to focus on what truly matters to you.

In conclusion, finding harmony as a freelance designer requires setting boundaries, prioritizing self-care, delegating tasks, cultivating a support system, practicing time management and productivity techniques, and learning to say no. By incorporating these secrets into your daily routine, you can achieve a balanced life as a freelance designer and thrive in both your professional and personal endeavors.

Mastering the Juggle: Tips for Freelance Designers

As a freelance designer, you have the unique challenge of juggling multiple projects, clients, deadlines, and personal responsibilities all at once. It can be overwhelming at times, but with the right strategies and mindset, you can master the juggle and design a balanced life that works for you.

Image Source: medium.com

One of the first tips for freelance designers is to prioritize your tasks and projects. Make a list of everything you need to accomplish, and then rank them in order of importance. This will help you focus on the most urgent and critical tasks first, ensuring that you meet deadlines and deliver quality work to your clients.

Another important tip is to establish boundaries between work and personal life. It can be tempting to work around the Clock, especially when deadlines are looming, but it’s essential to set limits and carve out time for yourself. Schedule breaks throughout the day, and create a designated workspace that you can step away from when the workday is done.

In addition to setting boundaries, it’s crucial to practice self-care as a freelance designer. Take care of your physical and mental health by eating well, exercising regularly, and getting enough sleep. Remember to take breaks and recharge when needed, whether that means taking a walk outside, meditating, or spending time with loved ones.

One of the challenges of freelancing is managing your finances and ensuring a steady income. As a freelance designer, it’s essential to track your expenses, set a budget, and save for taxes and emergencies. Consider setting aside a portion of your income each month for savings and investments to secure your financial future.

Networking is another key tip for freelance designers. Building relationships with other designers, clients, and industry professionals can lead to new opportunities, collaborations, and referrals. Attend networking events, join online communities, and connect with others in your field to expand your network and grow your freelance business.

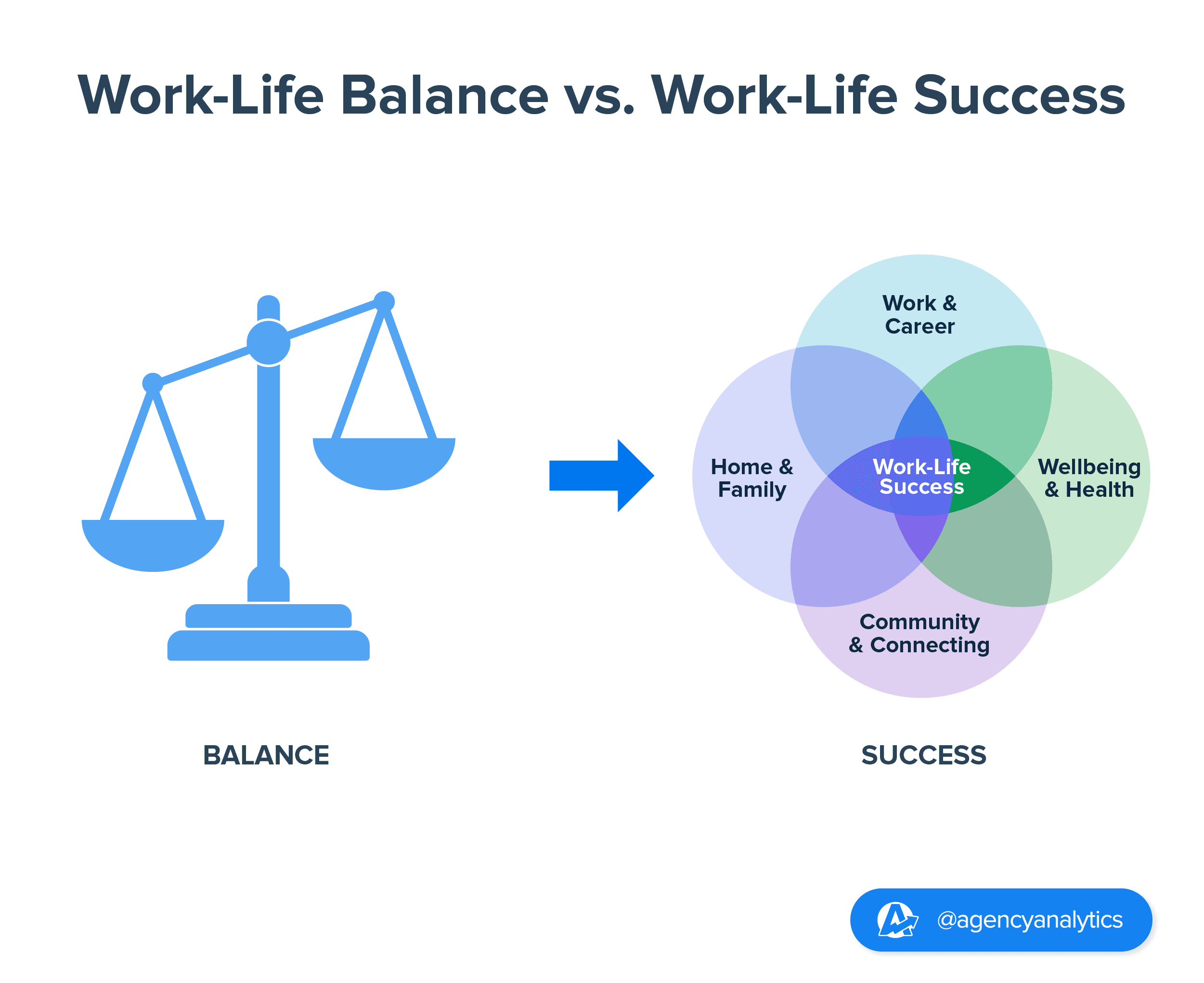

Image Source: agencyanalytics.com

Staying organized is essential for freelance designers, especially when juggling multiple projects. Use project management tools, calendars, and to-do lists to keep track of deadlines, tasks, and client communications. Set realistic goals and deadlines for each project, and break down tasks into manageable steps to stay on track and deliver quality work on time.

Creativity is at the heart of design, but it’s essential to find inspiration and avoid burnout as a freelance designer. Take breaks to recharge your creative energy, explore new hobbies and interests, and seek out inspiration in art, nature, and everyday life. Experiment with new techniques, styles, and mediums to keep your work fresh and innovative.

Finally, remember to have fun and enjoy the journey as a freelance designer. Embrace the flexibility and freedom that comes with freelancing, and take pride in the work you create for your clients. Stay curious, stay passionate, and continue to learn and grow as a designer to design a balanced life that brings you joy and fulfillment.

How to Balance Work and Life as a Freelance Designer

Image Source: rasmussen.edu

Image Source: shutterstock.com

Image Source: pinimg.com

Image Source: website-files.com

Image Source: ctfassets.net