Unleash Your Creativity: Mastering Freelance Web Design

When it comes to succeeding as a freelance web designer, one of the most important skills you can possess is creativity. The ability to think outside the box, come up with unique design ideas, and bring a client’s vision to life is what sets great web designers apart from the rest. In this article, we will explore how you can unleash your creativity and master the art of freelance web design.

One of the first steps to unleashing your creativity as a freelance web designer is to stay inspired. Surround yourself with sources of inspiration, whether it’s through browsing design blogs, attending web design conferences, or simply taking a walk in nature. By exposing yourself to new ideas and concepts, you can fuel your creativity and come up with fresh, innovative designs for your clients.

Another key aspect of mastering freelance web design is to experiment with different design techniques and tools. Don’t be afraid to try out new software, learn a new coding language, or explore different design trends. The more you push yourself out of your comfort zone, the more you will grow as a designer and the more unique and innovative your designs will become.

Collaboration is also a great way to unleash your creativity as a freelance web designer. By working with other designers, developers, and clients, you can gain new perspectives, learn new skills, and come up with ideas that you may not have thought of on your own. Don’t be afraid to reach out to other professionals in the industry and collaborate on projects – you never know what amazing designs may come out of it.

Image Source: weareindy.com

In addition to collaboration, seeking feedback is another important aspect of mastering freelance web design. Don’t be afraid to share your work with others and ask for their honest opinions. Constructive criticism can help you see your designs from a different perspective and make improvements that you may not have thought of on your own. By being open to feedback, you can continue to grow and evolve as a designer.

One final tip for unleashing your creativity as a freelance web designer is to always stay curious. Keep up with the latest design trends, technologies, and tools, and never stop learning. The world of web design is constantly evolving, and by staying curious and open-minded, you can continue to push the boundaries of your creativity and create designs that truly stand out.

In conclusion, mastering freelance web design requires a Combination of creativity, experimentation, collaboration, feedback, and curiosity. By following these tips and staying true to your creative vision, you can unleash your creativity and create stunning designs that will impress your clients and set you apart in the competitive world of freelance web design. So go ahead, unleash your creativity and master the art of freelance web design – the possibilities are endless.

Elevate Your Skills: Tips for Success in Freelance Design

Embarking on a career as a freelance web designer can be an exciting and rewarding journey. However, as with any profession, mastering the art of freelance web design requires a Combination of creativity, technical skills, and business acumen. In this article, we will explore some tips to help you elevate your skills and achieve success in the competitive world of freelance design.

First and foremost, it is essential to constantly strive to improve your technical skills. The field of web design is constantly evolving, with new technologies and trends emerging all the time. To stay ahead of the curve, be sure to regularly update your skills and knowledge. Take online courses, attend workshops, and seek out opportunities to learn from more experienced designers. By continuously honing your technical skills, you will be better equipped to tackle any project that comes your way.

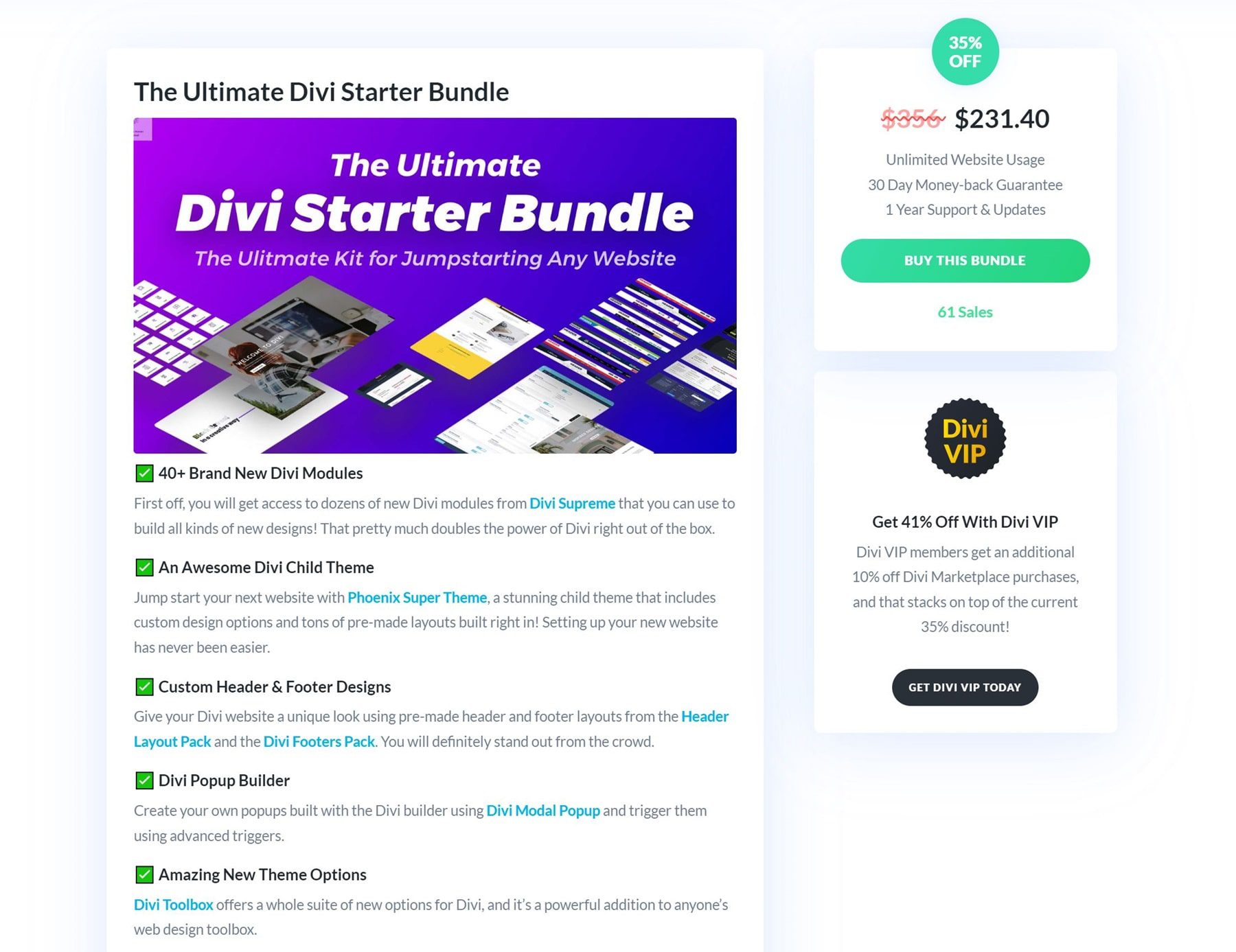

Image Source: elegantthemes.com

In addition to technical skills, successful freelance designers also possess strong creative abilities. The ability to think outside the box and come up with innovative design solutions is crucial in the world of web design. Experiment with different design styles, color schemes, and layouts to expand your creative repertoire. Don’t be afraid to take risks and push the boundaries of traditional design conventions. By daring to be different, you can set yourself apart from the competition and attract clients who are looking for fresh and unique design concepts.

Another key aspect of success in freelance design is building a strong portfolio. Your portfolio is essentially your calling card – it showcases your skills, style, and range of work to Potential clients. Make sure to curate a diverse selection of projects that demonstrate your versatility as a designer. Include examples of websites you have designed, as well as any other relevant work such as logo designs, branding projects, or digital illustrations. A well-rounded portfolio will help to attract a wider range of clients and demonstrate your ability to tackle a variety of design challenges.

Networking is also crucial in the world of freelance design. Building relationships with other designers, developers, and potential clients can open up new opportunities and lead to valuable collaborations. Attend industry events, join online design communities, and make an effort to connect with other professionals in the field. By networking effectively, you can tap into a wealth of resources, support, and advice that can help you grow as a designer and expand your freelance business.

Finally, it is important to remember that success in freelance design is not just about technical skills and creative talent – it also requires a solid business mindset. As a freelancer, you are not only responsible for designing websites, but also for managing your business, marketing your services, and handling client relationships. Be proactive in seeking out new clients, setting clear project timelines and expectations, and communicating effectively with your clients throughout the design process. By treating your freelance business as a professional enterprise, you can build a solid reputation and attract repeat business from satisfied clients.

In conclusion, mastering the art of freelance web design requires a combination of technical skills, creative abilities, and business acumen. By continually improving your skills, building a strong portfolio, networking with other professionals, and approaching your freelance business with professionalism and dedication, you can elevate your skills and achieve success in the competitive world of freelance design. So go ahead, unleash your creativity, push the boundaries, and take your freelance design career to new heights.

Image Source: ytimg.com

How to Become a Successful Freelance Web Designer

Image Source: licdn.com

![image.title How to Become a Freelance Web Developer [Full Guide] - Inside Kitchen image.title How to Become a Freelance Web Developer [Full Guide] - Inside Kitchen](https://kitchen.co/blog/wp-content/uploads/2021/03/how-to-become-a-freelance-web-developer-2.jpg)

Image Source: kitchen.co

Image Source: bluehost.com

Image Source: elegantthemes.com