Revamp Your Image: Personal Brand Audit 101

In today’s fast-paced and competitive world, it is more important than ever to make sure that you are putting your best foot forward when it comes to your personal brand. Your personal brand is how you present yourself to the world, and it can have a significant impact on your success and opportunities in both your personal and professional life. Conducting a personal brand audit is a great way to ensure that you are maximizing your impact and making the most of your Potential.

So, what exactly is a personal brand audit? Simply put, it is an evaluation of how you are currently presenting yourself to the world and how you can improve and refine your image. It involves taking a close look at your online presence, your social media accounts, your professional image, and your overall reputation. By conducting a personal brand audit, you can identify areas where you can make improvements and take steps to enhance your personal brand.

One of the first steps in conducting a personal brand audit is to review your online presence. This includes Googling yourself and seeing what comes up, as well as checking your social media accounts to make sure that they are presenting you in the best possible light. You should also take a look at any professional networking sites that you are a part of, such as LinkedIn, and make sure that your profile is up to date and accurately reflects your skills and experience.

Next, take a look at your professional image. This includes everything from your Wardrobe and grooming habits to your communication style and body language. Are you presenting yourself as confident, professional, and competent? If not, it may be time to make some changes. Consider updating your wardrobe, practicing good grooming habits, and working on your communication skills to ensure that you are presenting the best possible version of yourself to the world.

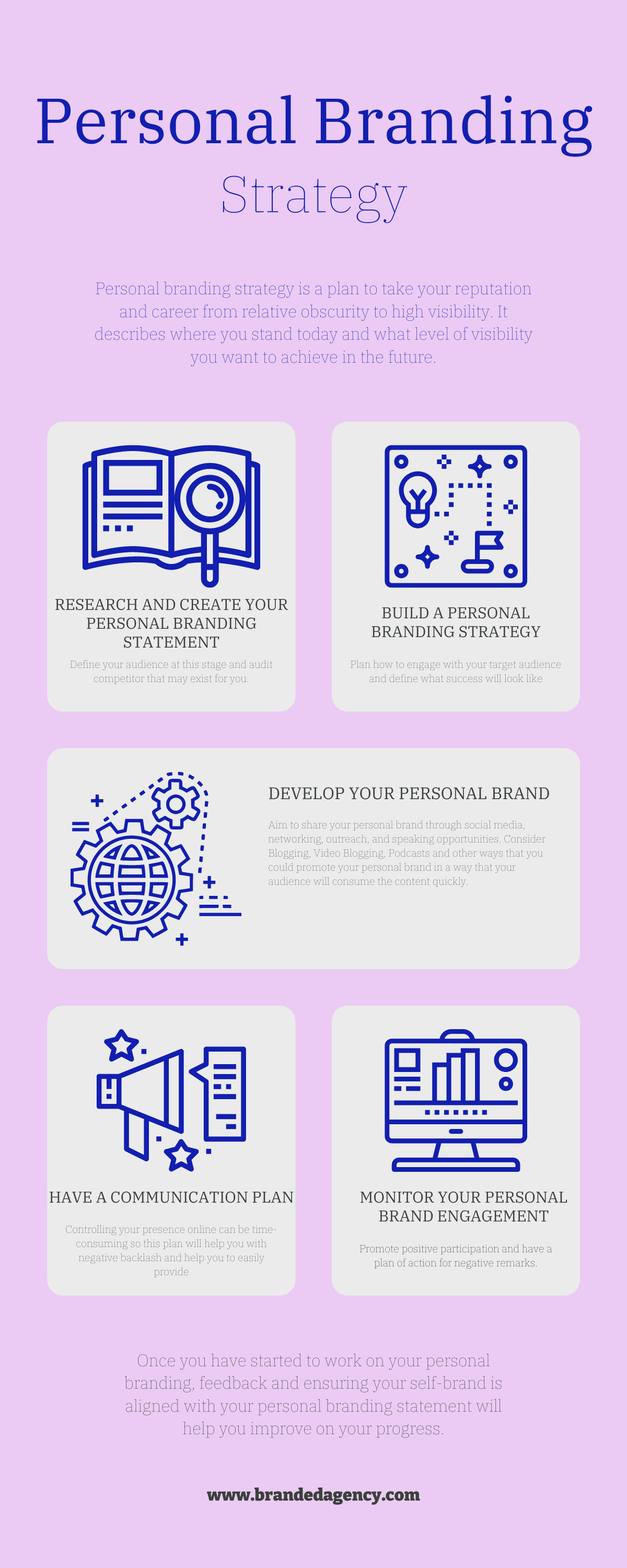

Image Source: website-files.com

In addition to your online presence and professional image, it is also important to consider your overall reputation. Do people see you as trustworthy, reliable, and competent? If not, it may be time to take steps to improve your reputation and build trust with others. This could involve taking on new projects, volunteering for leadership roles, or simply being more proactive in your interactions with others.

By conducting a personal brand audit and making improvements in these areas, you can maximize your impact and increase your opportunities for success. A strong personal brand can open doors, attract new opportunities, and help you stand out from the competition. So, take the time to evaluate your personal brand and make the necessary changes to ensure that you are presenting yourself in the best possible light. Your future self will thank you for it!

Unleash Your Potential: Strategies for Success

Are you ready to take your personal brand to the next level and maximize your impact? It’s time to unleash your potential and harness the power of strategic success strategies. In this article, we will explore some key tactics and tips to help you reach new heights in your personal brand audit journey.

One of the first steps in unleashing your potential is to identify your strengths and weaknesses. Take a close look at your current personal brand and evaluate what is working well and what may need improvement. Are you effectively communicating your unique value proposition? Are you leveraging all of your skills and experiences to their fullest potential? By conducting a thorough assessment of your personal brand, you can pinpoint areas for growth and development.

Once you have a clear understanding of your strengths and weaknesses, it’s time to develop a plan for success. Set specific, measurable goals that align with your personal brand vision and objectives. Whether you want to increase your visibility in your industry, build stronger relationships with key stakeholders, or expand your professional network, having a roadmap to guide your efforts is essential for success.

Image Source: licdn.com

In addition to setting goals, it’s important to take action and implement strategies that will help you achieve your objectives. This may involve enhancing your online presence through social media and networking platforms, attending industry events and conferences to expand your knowledge and connections, or seeking out mentorship and coaching to enhance your skills and expertise. By proactively pursuing opportunities for growth and development, you can unlock your full potential and make a lasting impact in your field.

Another key strategy for success is to continuously monitor and evaluate your progress. Keep track of your performance metrics, such as website traffic, social media engagement, and networking opportunities, to gauge the effectiveness of your personal branding efforts. Regularly review your goals and adjust your strategies as needed to stay on track and ensure that you are making the most of your potential.

In addition to assessing your own performance, it’s also important to seek feedback from others. Reach out to colleagues, mentors, and industry peers for their insights and perspectives on your personal brand. Ask for constructive criticism and suggestions for improvement, and be open to receiving feedback that can help you refine your strategies and maximize your impact.

Finally, don’t be afraid to take risks and try new approaches in your personal branding efforts. Innovation and creativity are key drivers of success, so be willing to step out of your comfort zone and experiment with different tactics and strategies. Stay curious and open-minded, and be willing to adapt and evolve as you continue to grow and develop your personal brand.

By unleashing your potential and implementing strategic success strategies, you can take your personal brand to new heights and make a lasting impact in your field. Remember to stay focused, stay proactive, and stay true to your unique value proposition as you embark on your personal brand audit journey. The possibilities are endless – so go ahead and unleash your potential today!

Image Source: squarespace-cdn.com

How to Do a Personal Brand Audit

Image Source: 1marketingidea.com

Image Source: squarespace-cdn.com

Image Source: licdn.com

Image Source: website-files.com

Image Source: licdn.com

Image Source: medium.com

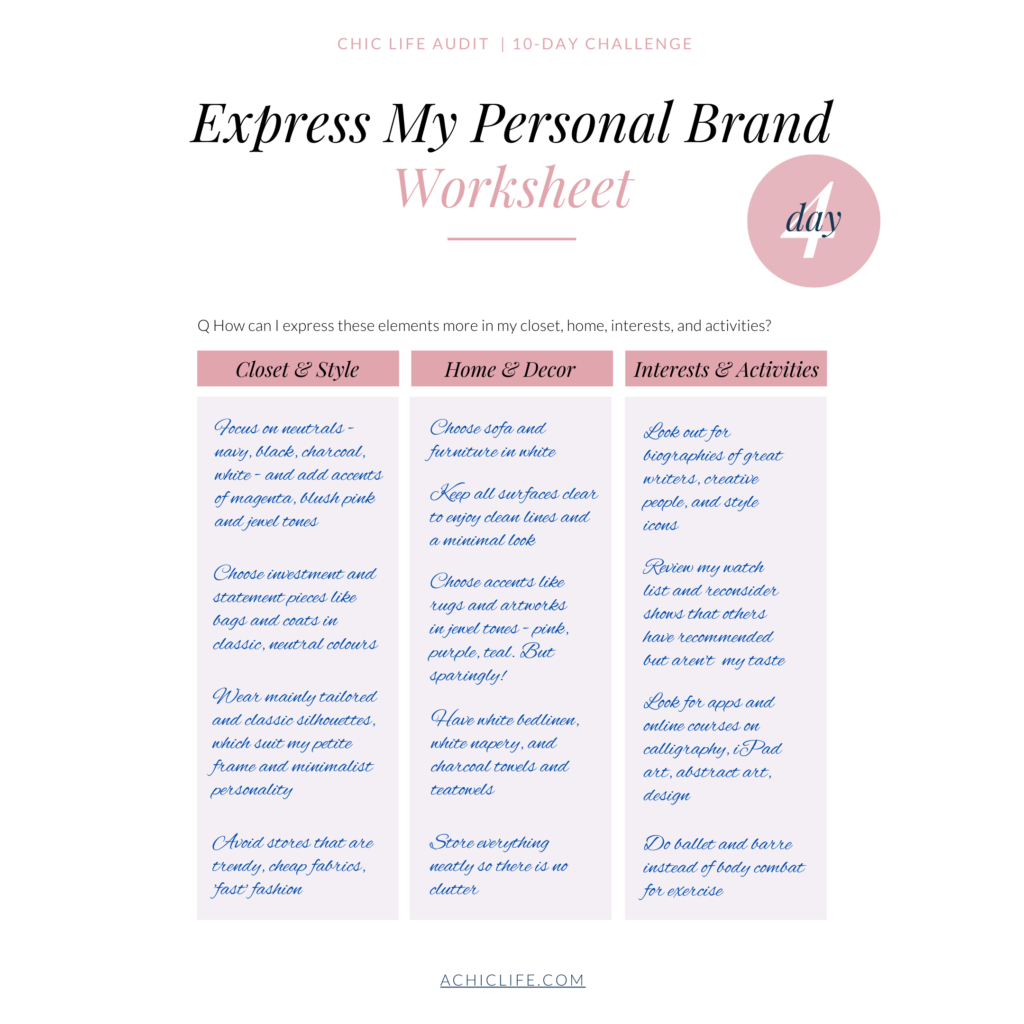

Image Source: achiclife.com

Image Source: eremedia.com

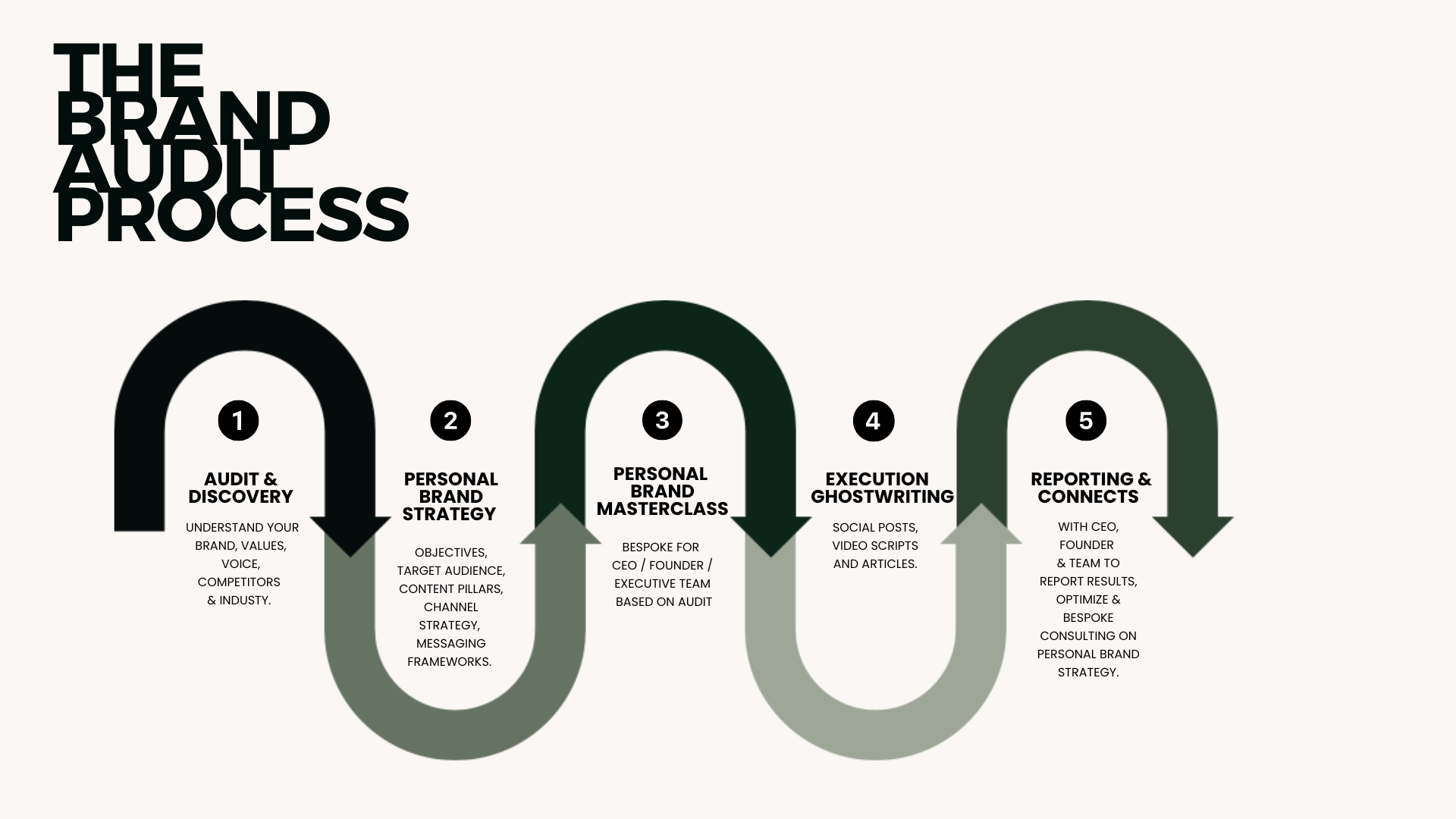

Image Source: thebrandaudit.ca

Image Source: thebrandaudit.ca