The Beauty of Minimalism

In a world filled with constant noise and distractions, simplicity is a breath of fresh air. This is especially true when it comes to design, where minimalism has become a popular trend in recent years. The beauty of minimalism lies in its ability to strip away the unnecessary and focus on what truly matters.

When it comes to user experience (UX) design, minimalism can play a crucial role in keeping users engaged. By removing clutter and distractions from a website or app, users are able to focus on the content or task at hand without feeling overwhelmed. This clean and simple approach not only creates a visually appealing design, but also enhances the overall user experience.

One of the key principles of minimalism is the idea of less is more. This means that by using fewer elements in a design, each element is able to stand out and have a greater impact. This can be seen in the use of white space, which helps to create a sense of balance and harmony in a design. By incorporating plenty of white space, users are able to navigate a website or app more easily and find the information they are looking for without feeling lost in a sea of clutter.

Another important aspect of minimalism is the use of simple and intuitive navigation. By keeping navigation menus clean and easy to understand, users are more likely to stay engaged and explore different parts of a website or app. This can be achieved through the use of clear labels, icons, and buttons that guide users through the site and help them find what they are looking for quickly and efficiently.

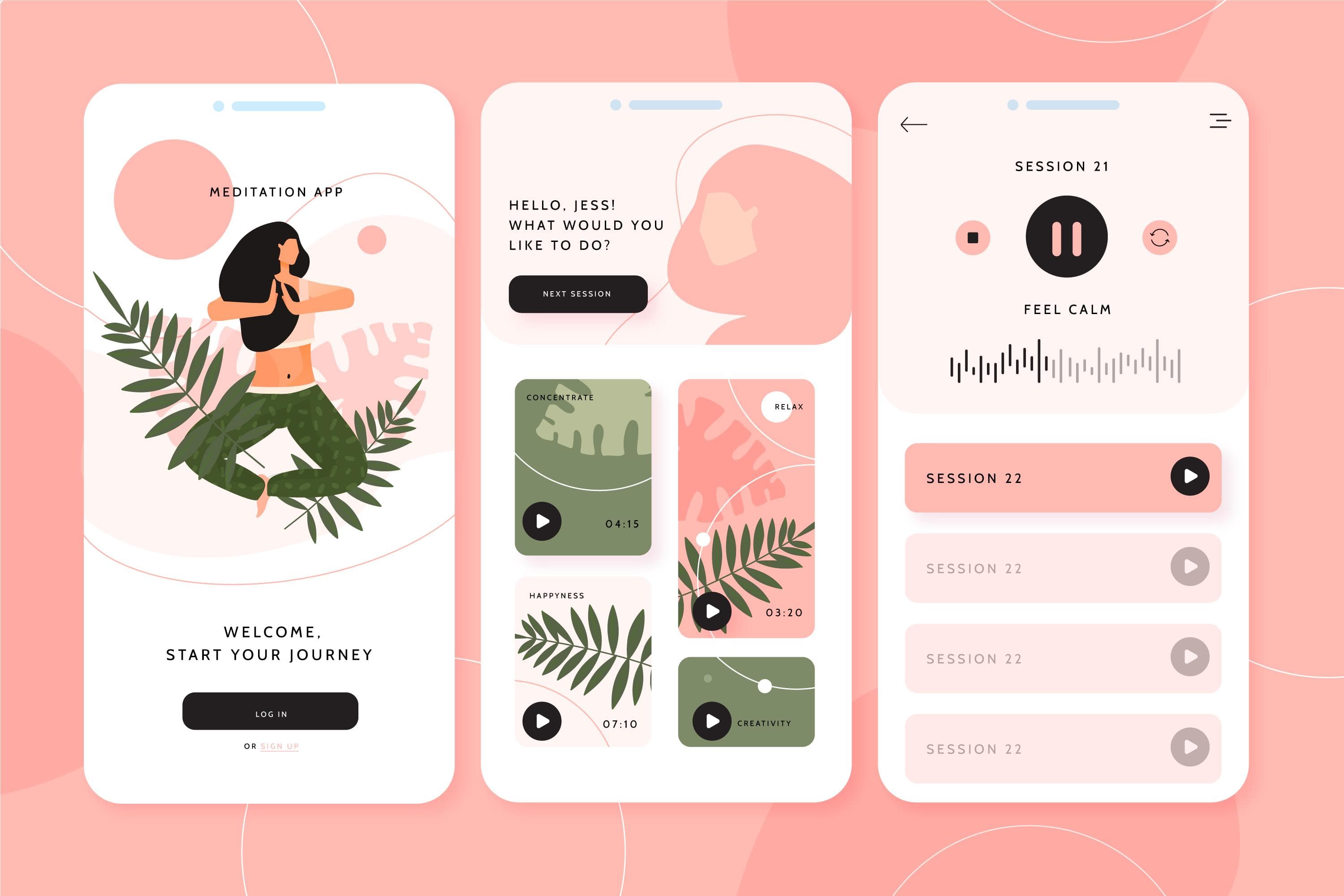

Image Source: toptal.io

In addition to improving navigation, minimalism can also help to create a more cohesive and consistent user experience. By sticking to a simple color palette, typography, and design style, users are able to easily recognize and remember a brand or website. This can help to build trust and loyalty among users, as they know what to expect and feel comfortable navigating the site.

One of the most important benefits of minimalism in design is its ability to improve loading times and performance. By reducing the number of elements on a page, such as images, videos, and animations, a website or app can load faster and provide a smoother user experience. This is crucial in today’s fast-paced digital world, where users expect instant gratification and will quickly abandon a site that takes too long to load.

Overall, the beauty of minimalism lies in its ability to create a clean, simple, and engaging user experience. By focusing on what truly matters and eliminating the unnecessary, designers can create websites and apps that are not only visually appealing but also highly functional. So the next time you’re designing a website or app, remember the power of minimalism and how it can keep users engaged and coming back for more.

Designing for User Engagement

When it comes to creating a successful user experience (UX) design, one of the key factors to consider is user engagement. Designing for user engagement involves creating a design that not only looks visually appealing but also keeps users interested and involved. In today’s fast-paced digital world, it is more important than ever to grab and hold the attention of users. This is where the concept of minimalistic design comes into play.

Minimalistic design is all about stripping away unnecessary elements and focusing on what is truly essential. By simplifying the design and eliminating distractions, users are able to focus on the core content and functionality of a website or application. This approach not only creates a clean and elegant aesthetic but also enhances usability and user engagement.

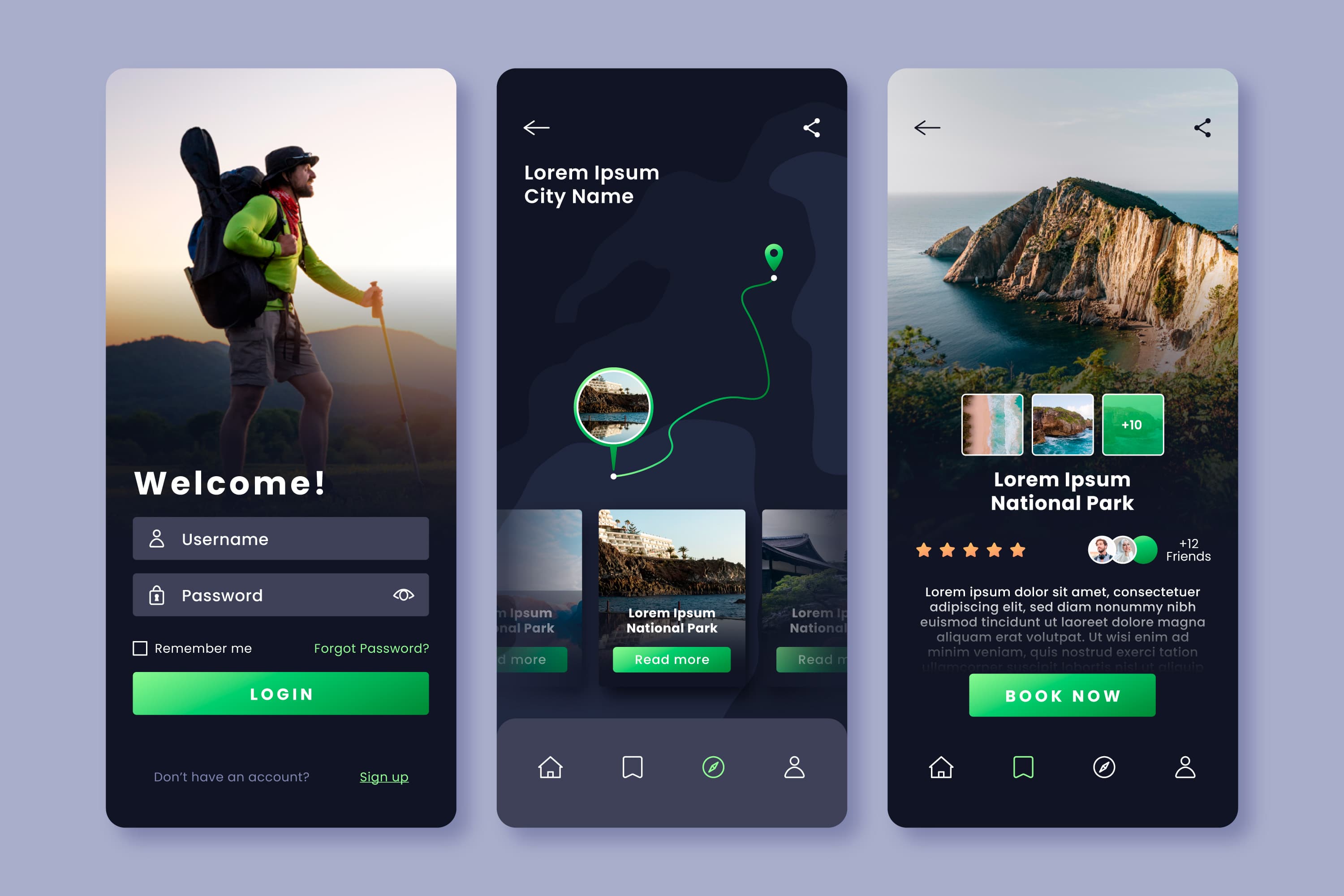

Image Source: geekyants.com

One of the key principles of minimalistic design is to prioritize the needs of the user. By understanding the goals and preferences of the target audience, designers can create a design that resonates with users and meets their needs effectively. This user-centric approach ensures that the design is intuitive and easy to navigate, leading to a more engaging user experience.

Another important aspect of designing for user engagement is the use of white space. White space, also known as negative space, refers to the empty space around elements in a design. By incorporating ample white space, designers can create a sense of balance and harmony, making it easier for users to digest information and navigate the interface. White space also helps to draw attention to key elements and guide users through the design.

In addition to white space, typography plays a crucial role in user engagement. The choice of fonts, sizes, and styles can have a significant impact on how users perceive and interact with a design. By selecting fonts that are easy to read and visually appealing, designers can enhance the overall user experience and keep users engaged. Consistent typography also helps to establish a sense of unity and coherence throughout the design.

When it comes to color, minimalistic design often relies on a limited palette to create a sense of simplicity and elegance. By using a restrained color scheme, designers can create a cohesive and visually pleasing design that is easy on the eyes. Colors can also be used strategically to highlight important elements and create visual hierarchy, guiding users through the design and focusing their attention where it is needed most.

Another important aspect of designing for user engagement is the use of intuitive navigation. A well-organized and easy-to-use navigation system is essential for keeping users engaged and helping them find the information they are looking for quickly and efficiently. By designing clear and intuitive navigation menus, designers can enhance the usability of a website or application and improve the overall user experience.

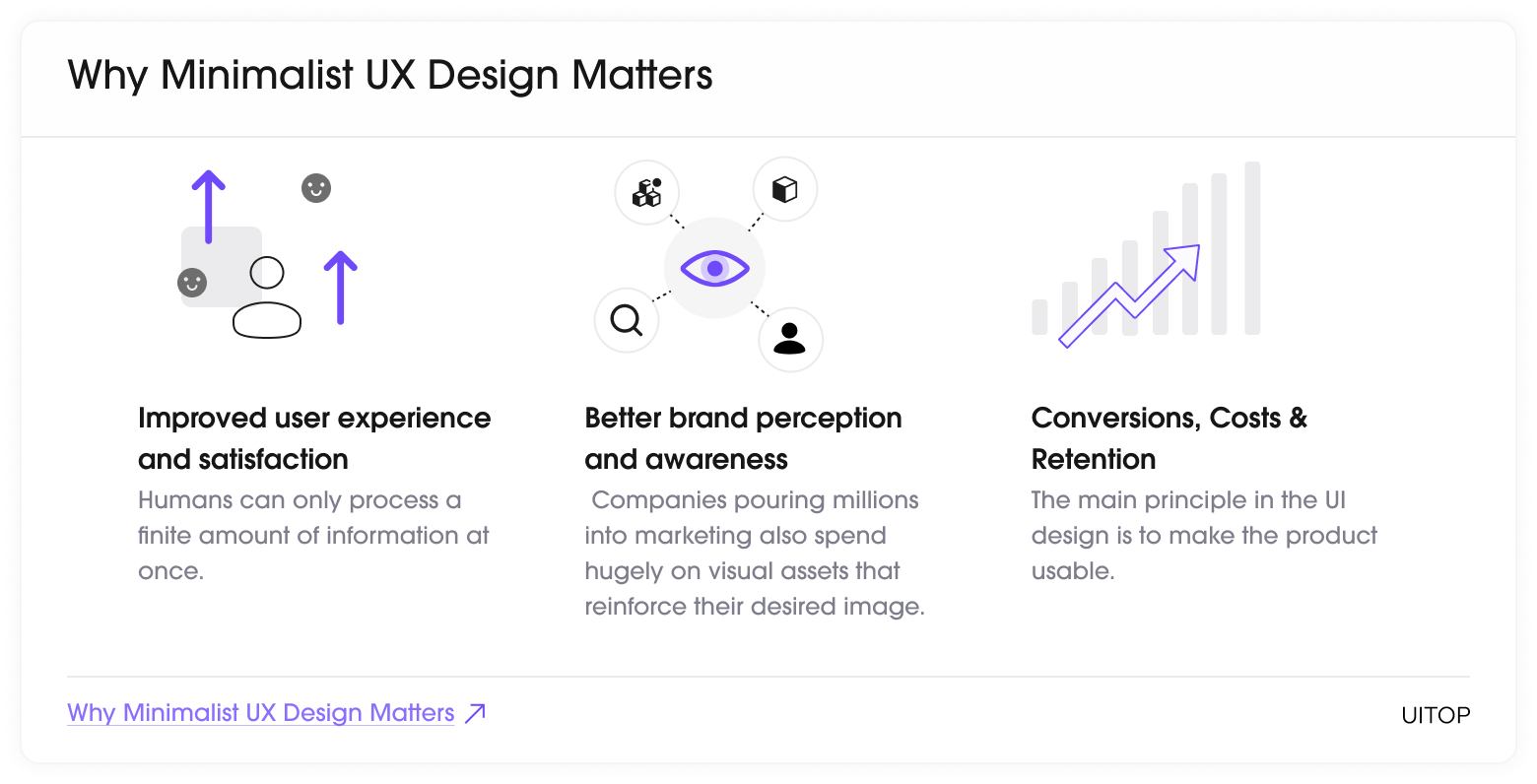

Image Source: uitop.design

In conclusion, designing for user engagement is essential for creating successful UX designs that keep users interested and involved. By embracing the principles of minimalistic design and focusing on user needs, designers can create clean, elegant, and user-friendly designs that enhance usability and drive engagement. By incorporating white space, typography, color, and intuitive navigation, designers can create designs that are not only visually appealing but also functional and engaging.

Minimalistic UX Designs That Keep Users Engaged

Image Source: geekyants.com

Image Source: justinmind.com

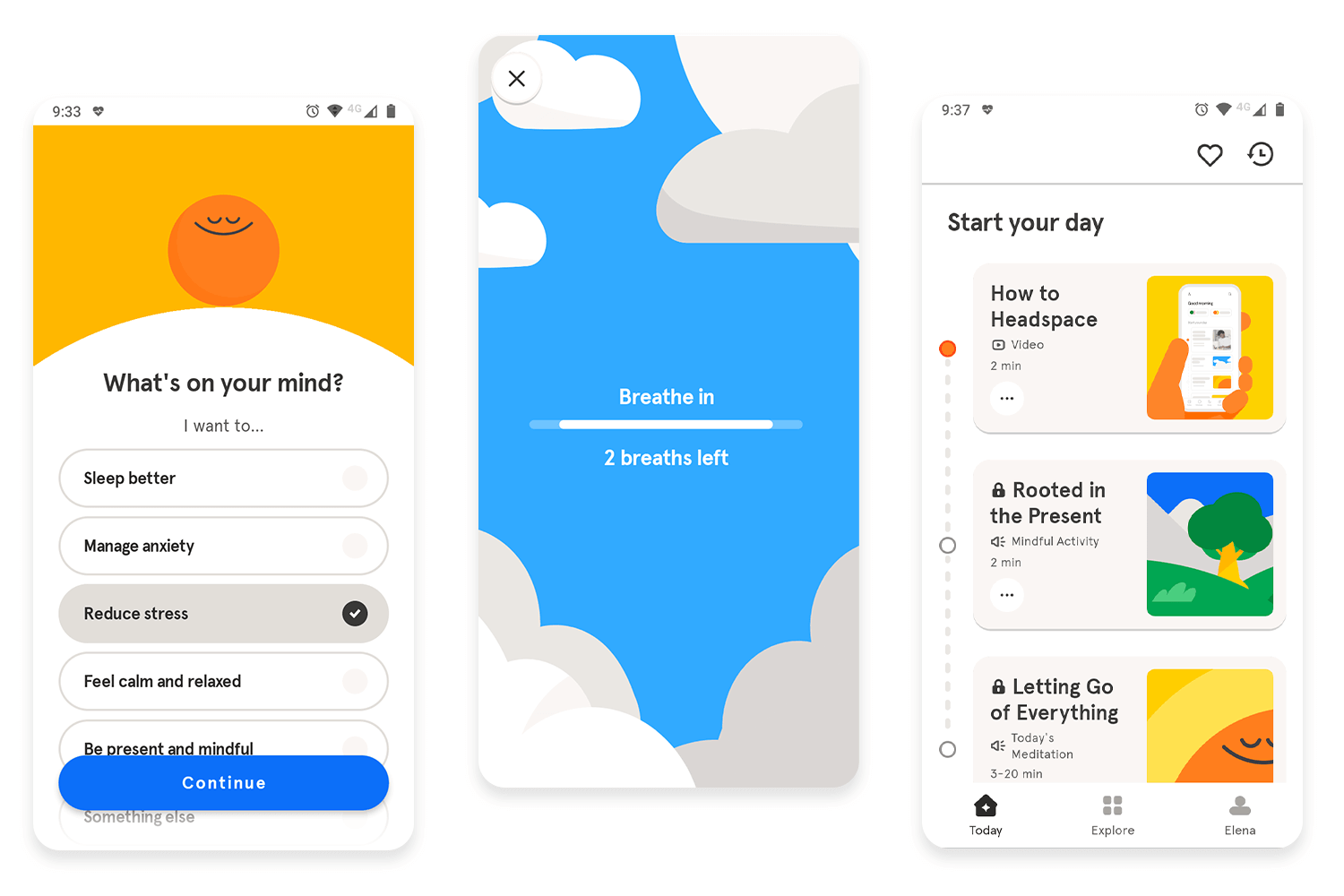

Image Source: aufaitux.com

Image Source: toptal.io