Unleash Your Creativity: Crafting a Personal Logo

Crafting a personal logo is a fun and exciting way to express your unique identity and showcase your creativity. Your personal logo is a visual representation of who you are, what you stand for, and what makes you special. It is a powerful tool that can help you stand out in a crowded marketplace and leave a lasting impression on others. In this article, we will explore some tips and tricks for crafting a personal logo that truly reflects you.

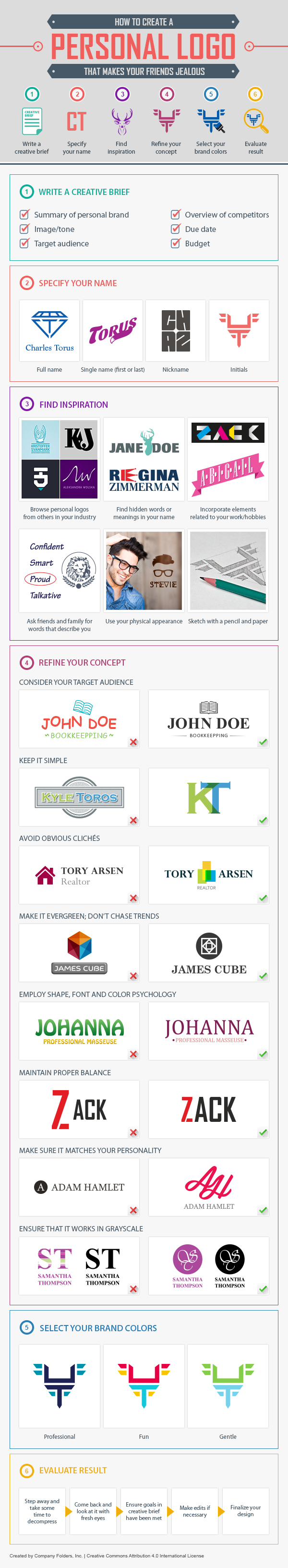

The first step in crafting a personal logo is to brainstorm ideas and concepts that resonate with you. Think about your hobbies, interests, values, and personality traits. What makes you unique? What sets you apart from others? Use these insights to inspire your logo design and create something that is truly one-of-a-kind.

Once you have a clear idea of what you want your personal logo to represent, it’s time to start sketching out some rough drafts. Don’t worry about making everything perfect at this stage – the goal is to get your ideas down on paper and start bringing them to life. Experiment with different shapes, colors, fonts, and symbols until you find a design that feels right for you.

As you work on refining your logo design, remember to keep it simple and versaTile. A good personal logo should be easy to recognize and remember, whether it’s printed on a business card, displayed on a website, or embroidered on a t-shirt. Avoid using too many elements or intricate details that can clutter your logo and make it difficult to reproduce across different mediums.

Image Source: companyfolders.com

Another important aspect to consider when crafting a personal logo is color psychology. Colors have the power to evoke emotions and convey meaning, so choose them wisely. Think about the message you want to communicate with your logo and select colors that align with that message. For example, blue is often associated with trust and reliability, while red conveys passion and energy.

Typography is another key element to consider when designing your personal logo. The font you choose can say a lot about your personality and style, so pick one that resonates with you. Play around with different typefaces and letterforms to see which ones best capture the essence of your brand. Whether you prefer a classic serif font or a modern sans-serif, make sure it complements the overall look and feel of your logo.

In addition to color and typography, symbols and icons can also play a significant role in your logo design. These visual elements can help convey your brand’s message in a simple and memorable way. Consider incorporating symbols that reflect your interests, values, or industry to add depth and meaning to your logo.

Once you have finalized your logo design, it’s important to test it out in various contexts to ensure its effectiveness. Try placing your logo on different backgrounds, resizing it, and using it in different applications to see how it looks and feels. Ask for feedback from friends, family, and colleagues to get a fresh perspective on your design.

In conclusion, crafting a personal logo is a creative and rewarding process that can help you define and showcase your unique identity. By unleashing your creativity, exploring different design options, and staying true to yourself, you can create a logo that truly reflects who you are and what you stand for. So go ahead, grab a pen and paper, and start crafting your personal logo today!

Creating a personal logo is not just about putting together some images and text – it’s about discovering and expressing your unique style and identity. Your logo is a visual representation of who you are, what you stand for, and what sets you apart from others. In this article, we will explore the process of designing a personal logo that truly reflects you and your individuality.

Discover Your Unique Style

Image Source: mysignature.io

When it comes to designing your personal logo, the first step is to discover your unique style. Your style is a reflection of your personality, interests, and values, and it should be the foundation of your logo design. Take some time to think about what makes you different from everyone else. What are your passions? What colors, shapes, and symbols resonate with you? These are all important factors to consider when crafting a logo that truly represents who you are.

One way to discover your unique style is to create a mood board. A mood board is a collection of images, colors, and textures that inspire and represent you. It can include anything from photographs and magazine clippings to fabric swatches and typography samples. By putting together a mood board, you can visually see what resonates with you and use it as a reference point when designing your logo.

Another way to discover your unique style is to look at your past work and projects. What design elements do you consistently use? What colors do you gravitate towards? By analyzing your previous work, you can uncover patterns and themes that are uniquely yours. Use these insights to inform your logo design and incorporate elements that reflect your personal style.

Once you have a good understanding of your unique style, it’s time to start brainstorming ideas for your logo. Think about what symbols, fonts, and colors best represent who you are. Consider incorporating elements that have personal significance to you, whether it’s a favorite flower, a meaningful quote, or a symbol of your heritage. The key is to create a logo that is not only visually appealing but also meaningful and authentic to you.

As you begin sketching out ideas for your logo, don’t be afraid to experiment and try different variations. Play around with different layouts, fonts, and colors until you find a design that feels right. Remember, your logo should be a reflection of you, so trust your instincts and go with what feels true to your unique style.

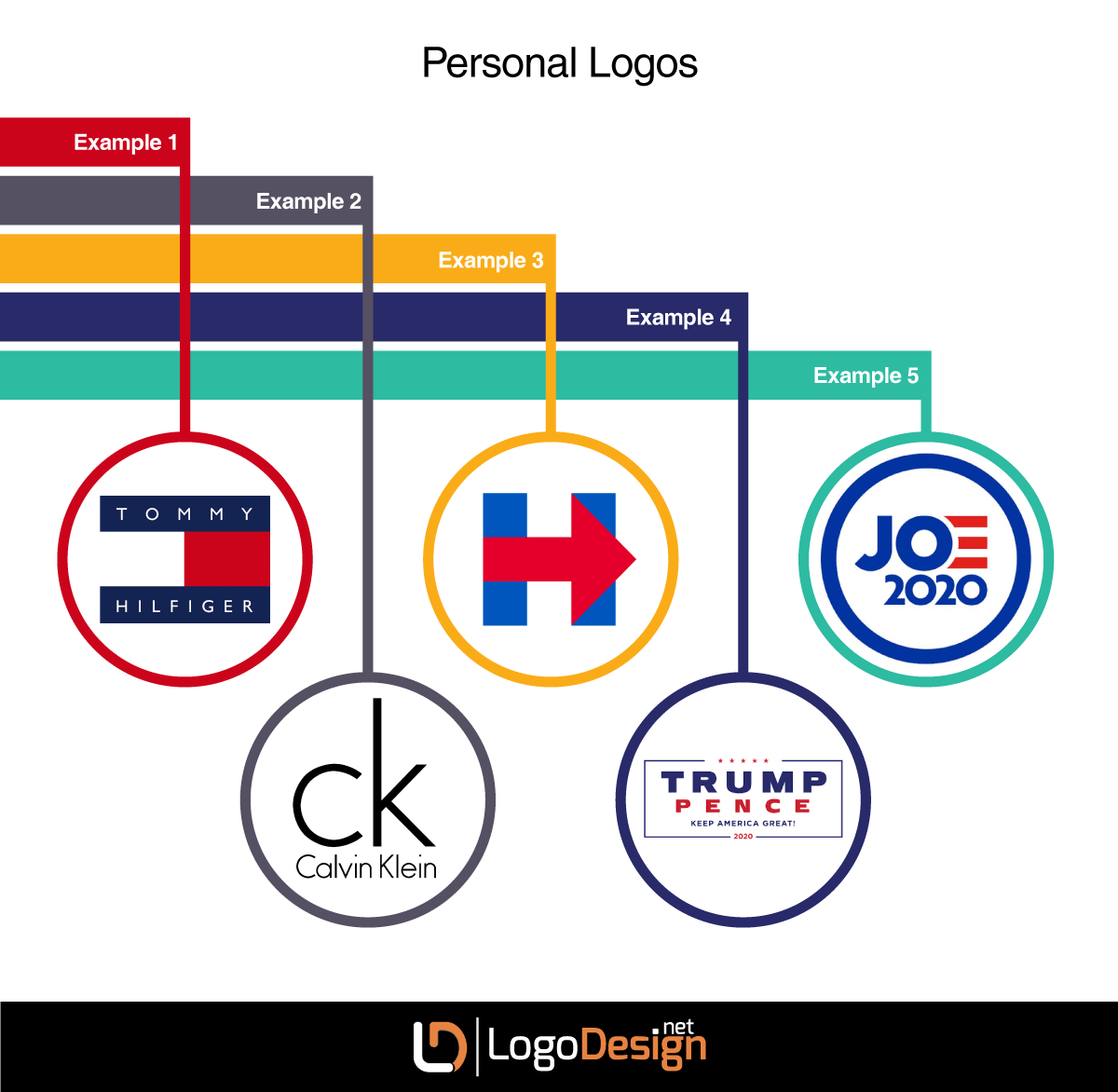

Image Source: logodesign.net

Once you have a few logo concepts that you’re happy with, it’s time to refine and finalize your design. Consider seeking feedback from friends, family, or colleagues to get different perspectives on your logo. Their input can help you identify areas for improvement and make your logo even stronger and more reflective of your unique style.

In conclusion, designing a personal logo is not just about creating a visual mark – it’s about crafting a symbol of your identity and expressing your individuality. By discovering your unique style and incorporating elements that are meaningful to you, you can create a logo that truly reflects who you are. So take the time to explore your passions, experiment with different design elements, and trust your instincts as you design a logo that is authentically you.

How to Design a Personal Logo That Represents You

Image Source: amazonaws.com

Image Source: medium.com

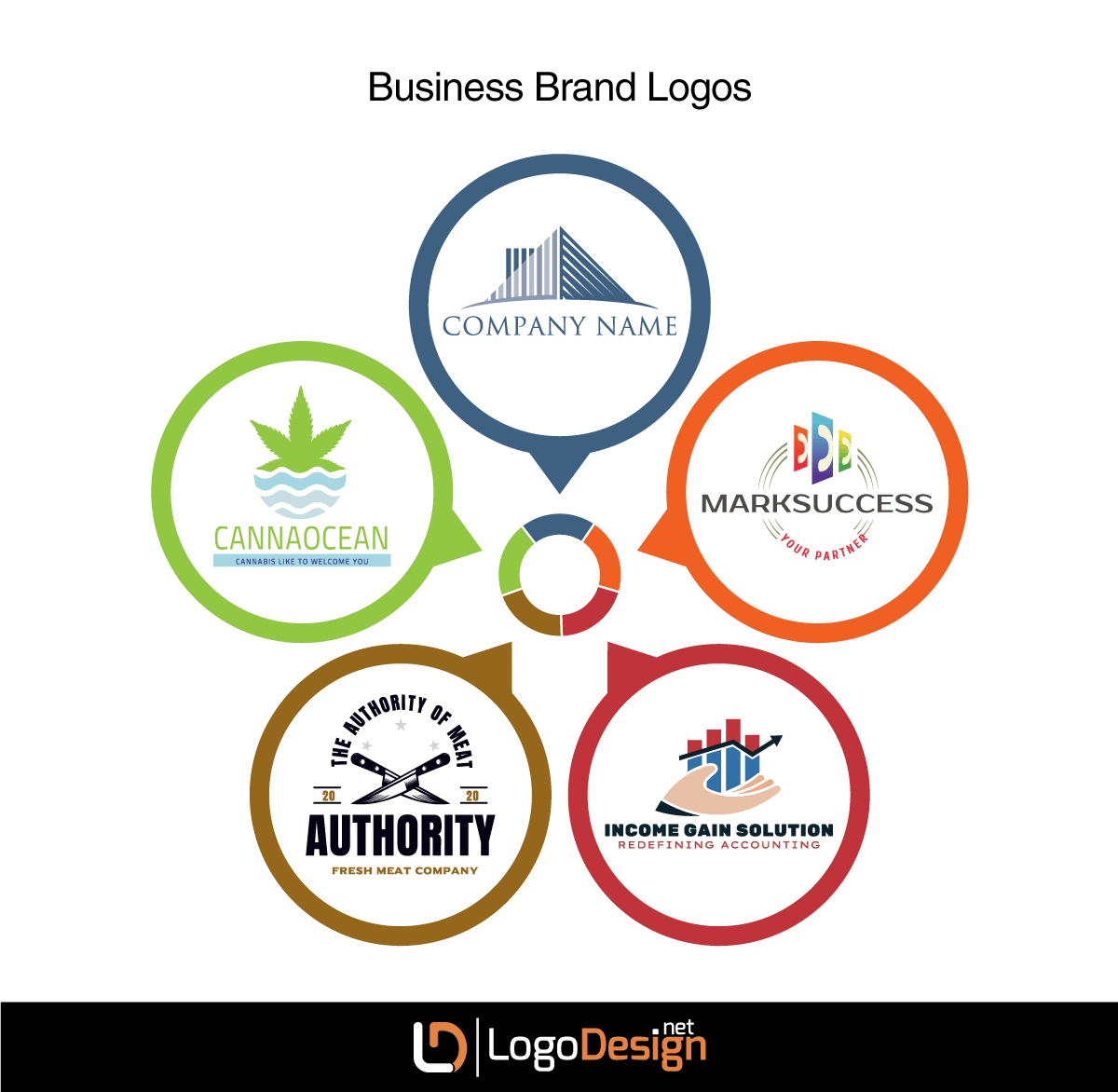

Image Source: logodesign.net