Shine Bright: Boost Your Blog’s Visibility

Are you looking to increase the visibility of your blog and attract more readers? In the competitive world of blogging, it’s essential to shine bright and stand out from the crowd. By implementing a few key strategies, you can boost your blog’s visibility and reach a wider audience.

One of the most effective ways to increase your blog’s visibility is to optimize your posts for search engines. Search engine optimization, or SEO, is the process of improving your website’s ranking in search engine results pages. By optimizing your posts for SEO, you can increase your chances of appearing higher in search engine rankings and attracting more organic traffic to your blog.

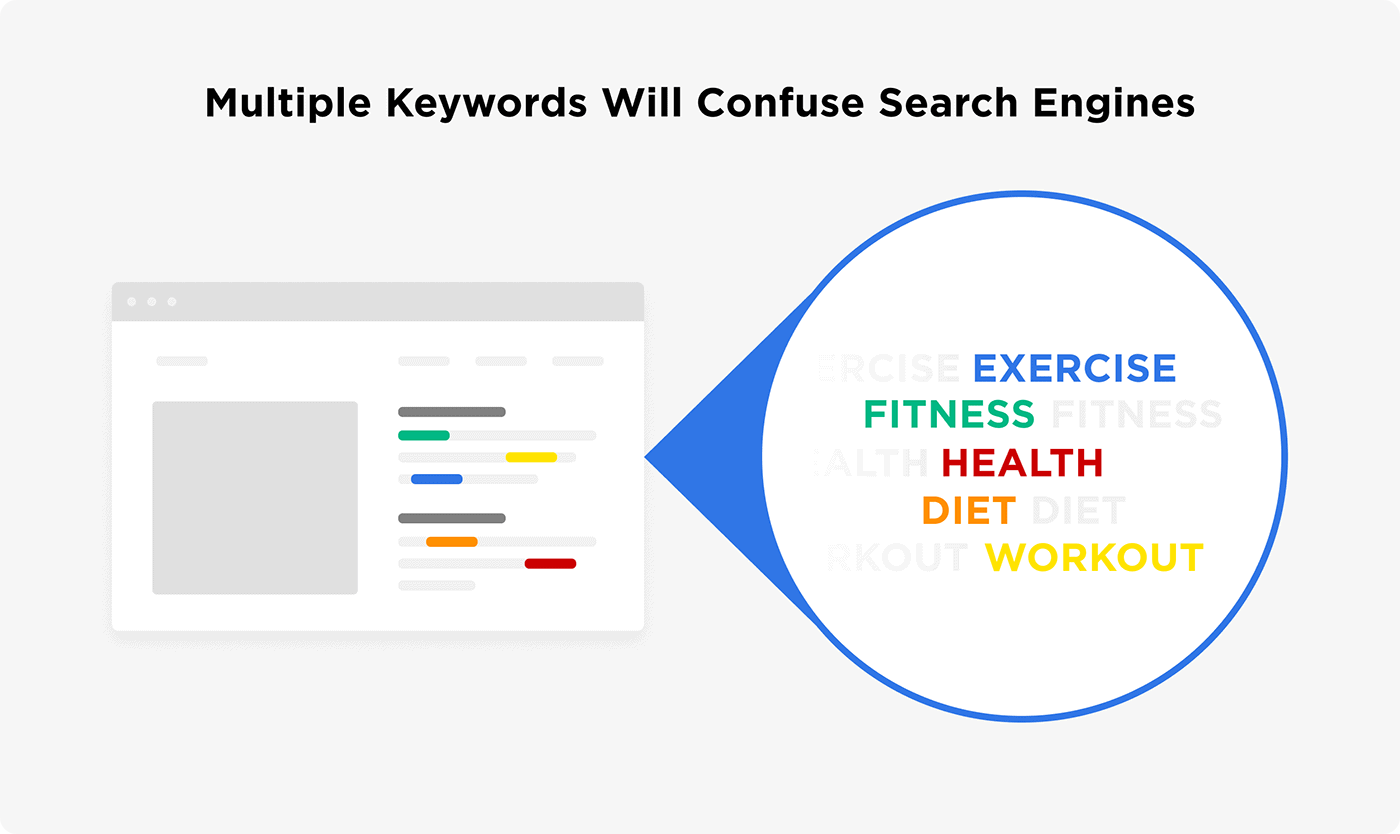

To start optimizing your posts for search engines, begin by conducting keyword research. Keywords are the words and phrases that people type into search engines when looking for information online. By incorporating relevant keywords into your blog posts, you can increase your chances of ranking higher in search engine results pages for those specific keywords.

When conducting keyword research, focus on long-tail keywords that are specific to your blog niche. Long-tail keywords are longer, more specific phrases that are less competitive than shorter, more generic keywords. By targeting long-tail keywords, you can increase your chances of ranking higher in search engine results pages for those specific keywords.

Image Source: autojini.com

Once you have identified relevant keywords for your blog posts, it’s time to strategically incorporate them into your content. Include your target keywords in your blog post title, headings, meta descriptions, and throughout the body of your post. However, be sure to use keywords naturally and avoid keyword stuffing, as this can negatively impact your blog’s visibility.

In addition to optimizing your posts for keywords, it’s also important to create high-quality, engaging content that is valuable to your readers. Search engines prioritize content that is informative, relevant, and well-written. By creating valuable content that resonates with your target audience, you can increase your blog’s visibility and attract more readers.

Another key strategy for boosting your blog’s visibility is to optimize your images for search engines. Search engines can’t see images, so it’s important to optimize your image file names, alt text, and descriptions with relevant keywords. By optimizing your images for search engines, you can increase your chances of appearing in image search results and driving more traffic to your blog.

In addition to optimizing your posts for search engines, it’s also important to promote your blog across various online platforms. Share your blog posts on social media, participate in online communities and forums related to your blog niche, and collaborate with other bloggers to increase your blog’s visibility and reach a wider audience.

By implementing these key strategies for optimizing your posts for search engines, you can shine bright and boost your blog’s visibility. With a little time and effort, you can increase your blog’s visibility, attract more readers, and establish yourself as an authority in your blog niche. So, don’t be afraid to shine bright and make your blog stand out from the crowd!

Top Tips for SEO Success on Your Blog

Image Source: licdn.com

Do you want to increase your blog’s visibility and reach a wider audience? Search Engine Optimization (SEO) is the key to achieving this goal. By optimizing your blog posts for search engines, you can improve your ranking on search engine results pages and attract more organic traffic to your site. Here are some top tips for SEO success on your blog:

1. Use Relevant Keywords: Keywords are the foundation of SEO. Research and choose relevant keywords that your target audience is likely to use when searching for content like yours. Incorporate these keywords strategically throughout your blog posts, including in the title, headings, meta descriptions, and body content.

2. Create High-Quality Content: Search engines value high-quality, original content. Make sure your blog posts are well-written, informative, and engaging. Avoid duplicate content and aim to provide valuable information that will keep your readers coming back for more.

3. Optimize Your Meta Tags: Meta tags, including meta titles and meta descriptions, are important for SEO. Make sure your meta tags accurately describe the content of your blog posts and include relevant keywords to improve your chances of ranking higher in search results.

4. Use Descriptive URLs: When creating URLs for your blog posts, use descriptive keywords that accurately reflect the content of the post. Avoid using generic URLs or numbers and symbols that do not provide any information about the content.

Image Source: martech.zone

5. Optimize Your Images: Images are an important part of blog posts, but they can also impact your SEO. Make sure to optimize your images by using descriptive file names and alt text that include relevant keywords. This will help search engines understand the content of the images and improve your overall SEO.

6. Create Internal Links: Internal linking is a great way to improve your blog’s SEO. Link to other relevant blog posts or pages on your site within your content to help search engines understand the structure of your site and the relationship between different pages.

7. Improve Your Site Speed: Site speed is a key ranking factor for search engines. Make sure your blog loads quickly on all devices by optimizing images, using a reliable hosting provider, and minimizing unnecessary plugins or scripts that could slow down your site.

8. Mobile Optimization: With more and more people using mobile devices to access the internet, it’s essential to ensure that your blog is mobile-friendly. Optimize your site for mobile users by using a responsive design, fast loading times, and easy navigation.

9. Monitor Your Performance: Keep track of your blog’s performance using tools like Google Analytics. Monitor your organic traffic, keyword rankings, and other important metrics to identify areas for improvement and track your progress over time.

Image Source: ecoyork.com

By following these top tips for SEO success on your blog, you can maximize your blog’s visibility and attract more organic traffic from search engines. With a strategic approach to SEO, you can improve your ranking, reach a wider audience, and ultimately grow your blog into a valuable resource for your readers.

How to Optimize Blog Posts for Search Engines

Image Source: backlinko.com

Image Source: ytimg.com

Image Source: paradoxmarketing.io

Image Source: isu.pub