Dream Job Discovery: Unleash Your Creative Potential

Are you a creative individual who is searching for your dream job? Do you feel like you have untapped potential just waiting to be unleashed? If so, you’re in the right place! In this article, we will explore strategies for unlocking your creative potential and landing your dream job as a creative professional.

As a creative person, you possess a unique set of skills and talents that set you apart from others. Whether you’re an artist, writer, designer, or musician, your creativity is a valuable asset that can help you succeed in the competitive job market. However, in order to truly unlock your potential and find your dream job, you need to take the time to discover what truly inspires and motivates you.

One of the first steps in unlocking your creative potential is to identify your passions and interests. What are you truly passionate about? What activities make you feel alive and energized? By taking the time to explore your interests, you can gain a better understanding of what type of work will bring you fulfillment and satisfaction.

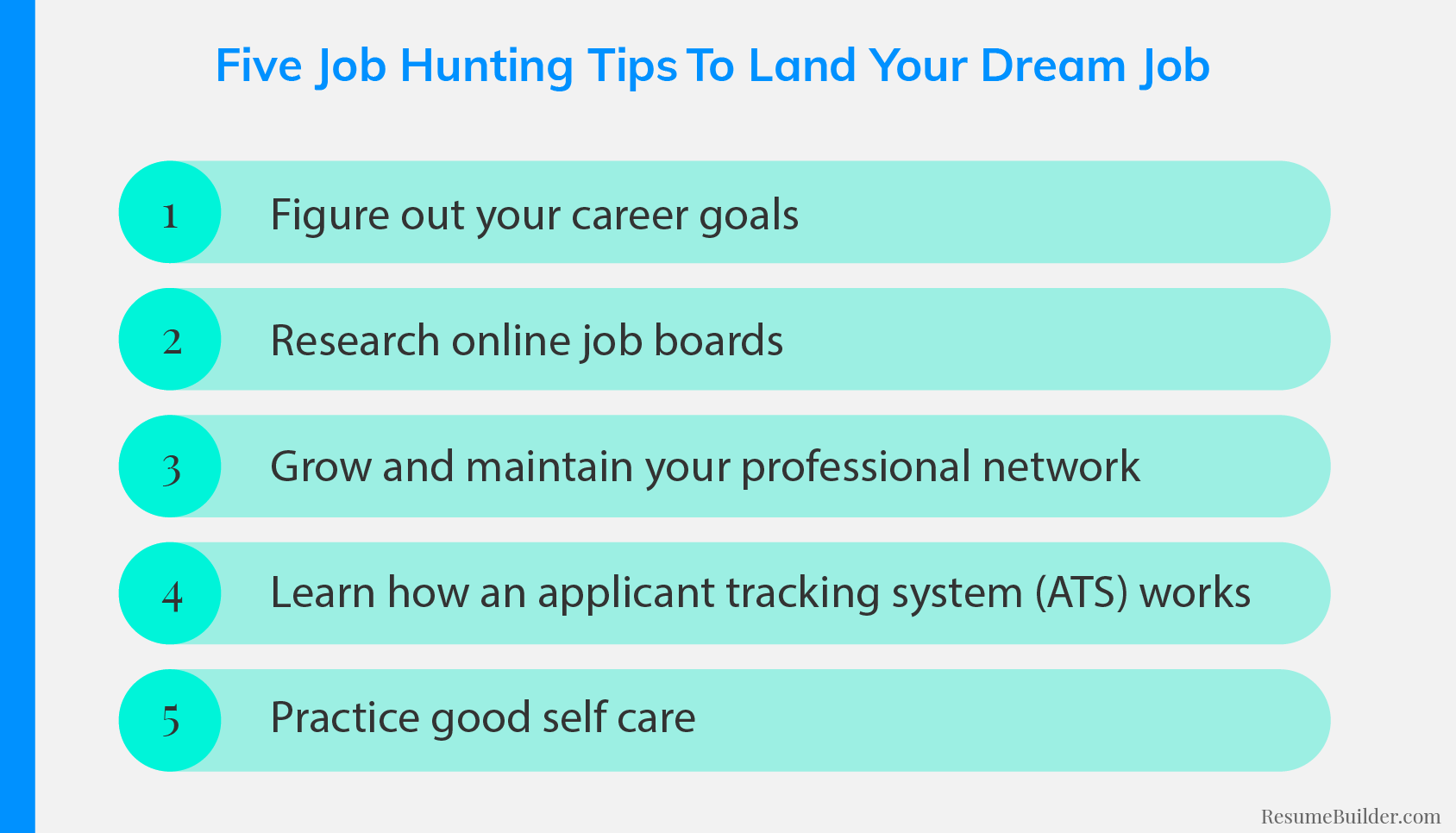

Once you have identified your passions, it’s important to set goals for yourself. What do you hope to achieve in your career as a creative professional? By setting specific, measurable goals, you can create a roadmap for success and stay motivated as you work towards your dream job.

Image Source: resumebuilder.com

In addition to setting goals, it’s also important to develop a strong personal brand as a creative professional. Your personal brand is a reflection of who you are as a creative individual and what sets you apart from others in your field. By showcasing your unique talents and skills through your portfolio, resume, and online presence, you can attract the attention of potential employers and stand out from the competition.

Networking is another key strategy for landing your dream job as a creative professional. By attending industry events, connecting with other creative professionals, and building relationships with potential employers, you can expand your network and uncover new opportunities for career advancement. Remember, it’s not just what you know, but who you know that can help you unlock your potential and achieve your career goals.

In addition to networking, it’s also important to seek out mentorship and guidance from experienced professionals in your field. By learning from the wisdom and experience of others, you can gain valuable insights and advice that can help you navigate the challenges of the job market and accelerate your career growth.

Finally, don’t be afraid to take risks and step outside of your comfort zone. In order to truly unlock your creative potential and land your dream job, you need to be willing to try new things, take on new challenges, and push yourself to grow and evolve as a creative professional. Remember, the path to success is not always easy, but by staying true to yourself and your passions, you can achieve your goals and live the life of your dreams.

In conclusion, unlocking your creative potential and landing your dream job as a creative professional is a journey that requires dedication, passion, and perseverance. By following the strategies outlined in this article, you can discover what truly inspires you, set goals for yourself, develop a strong personal brand, network with other professionals, seek out mentorship, and take risks to achieve your career goals. So what are you waiting for? It’s time to unleash your creative potential and pursue your dreams with confidence and determination.

Pathway to Success: Strategies for Creative Professionals

Image Source: careermastered.com

As a creative professional, landing your dream job can be both exciting and challenging. With the right strategies in place, you can unlock your Potential and achieve success in your career. In this article, we will explore some key strategies that can help you on your pathway to success as a creative professional.

One of the first steps in unlocking your potential as a creative professional is to establish a clear vision for your career goals. Take the time to reflect on what you are truly passionate about and what type of work brings you the most joy and fulfillment. By defining your goals and aspirations, you can create a roadmap for your career that will guide you towards your dream job.

Once you have a clear vision of your career goals, it is important to develop a strong portfolio that showcases your skills and talents. Your portfolio is a visual representation of your work and capabilities, so make sure to curate it carefully to highlight your best projects and achievements. A strong portfolio can help you stand out to potential employers and demonstrate your creative abilities.

Networking is also a crucial strategy for creative professionals looking to land their dream job. Build relationships with other professionals in your industry, attend networking events, and connect with potential employers on social media platforms like LinkedIn. Networking can open doors to new opportunities and help you establish connections that can lead to your dream job.

In addition to networking, continuous learning and skill development are essential for creative professionals to stay competitive in their field. Take advantage of workshops, online courses, and conferences to expand your knowledge and learn new techniques and technologies. By staying current with industry trends and honing your skills, you can position yourself as a valuable asset to potential employers.

Image Source: kiranacolleges.edu.au

Another key strategy for creative professionals is to stay adaptable and open to new opportunities. The creative industry is constantly evolving, so it is important to be flexible and willing to explore different paths in your career. Embrace new challenges and experiences, and be open to taking on projects that push you out of your comfort zone. By embracing change and growth, you can position yourself for success in your career.

Finally, it is important for creative professionals to stay true to their authentic selves and their unique creative voice. Don’t be afraid to showcase your personality and individuality in your work, as this is what sets you apart from other professionals in your field. Your creative voice is your greatest asset, so embrace it fully and let it shine through in everything you do.

In conclusion, unlocking your potential and landing your dream job as a creative professional requires a Combination of vision, hard work, networking, continuous learning, adaptability, and authenticity. By following these strategies and staying true to yourself, you can achieve success in your career and fulfill your creative aspirations. Embrace the journey and enjoy the process of unlocking your full potential as a creative professional.

How to Find Your Dream Job as a Creative Professional

Image Source: resume.io

Image Source: iabcindonesia.com

Image Source: eslbuzz.com

Image Source: lemon8-app.com