Unleash Your Marketing Potential

In the fast-paced world of marketing, it’s important to constantly be evolving and pushing the boundaries of what is possible. No matter what industry you’re in, there is always room for growth and improvement. That’s why it’s crucial to unleash your marketing potential and take your strategies to the next level.

So, how can you unleash your marketing potential and create a winning marketing calendar? It all starts with understanding your audience. Who are they? What are their needs and pain points? By truly understanding your target market, you can tailor your marketing efforts to speak directly to them.

Next, it’s important to set clear and achievable goals. What do you want to achieve with your marketing efforts? Whether it’s increasing brand awareness, driving sales, or launching a new product, having clear goals will help guide your strategy and measure your success.

Once you have a solid understanding of your audience and your goals, it’s time to get creative. Think outside the box and come up with innovative ideas that will capture the attention of your target market. Whether it’s a quirky social media campaign, a viral video, or a unique partnership, creativity is key to standing out in a crowded marketplace.

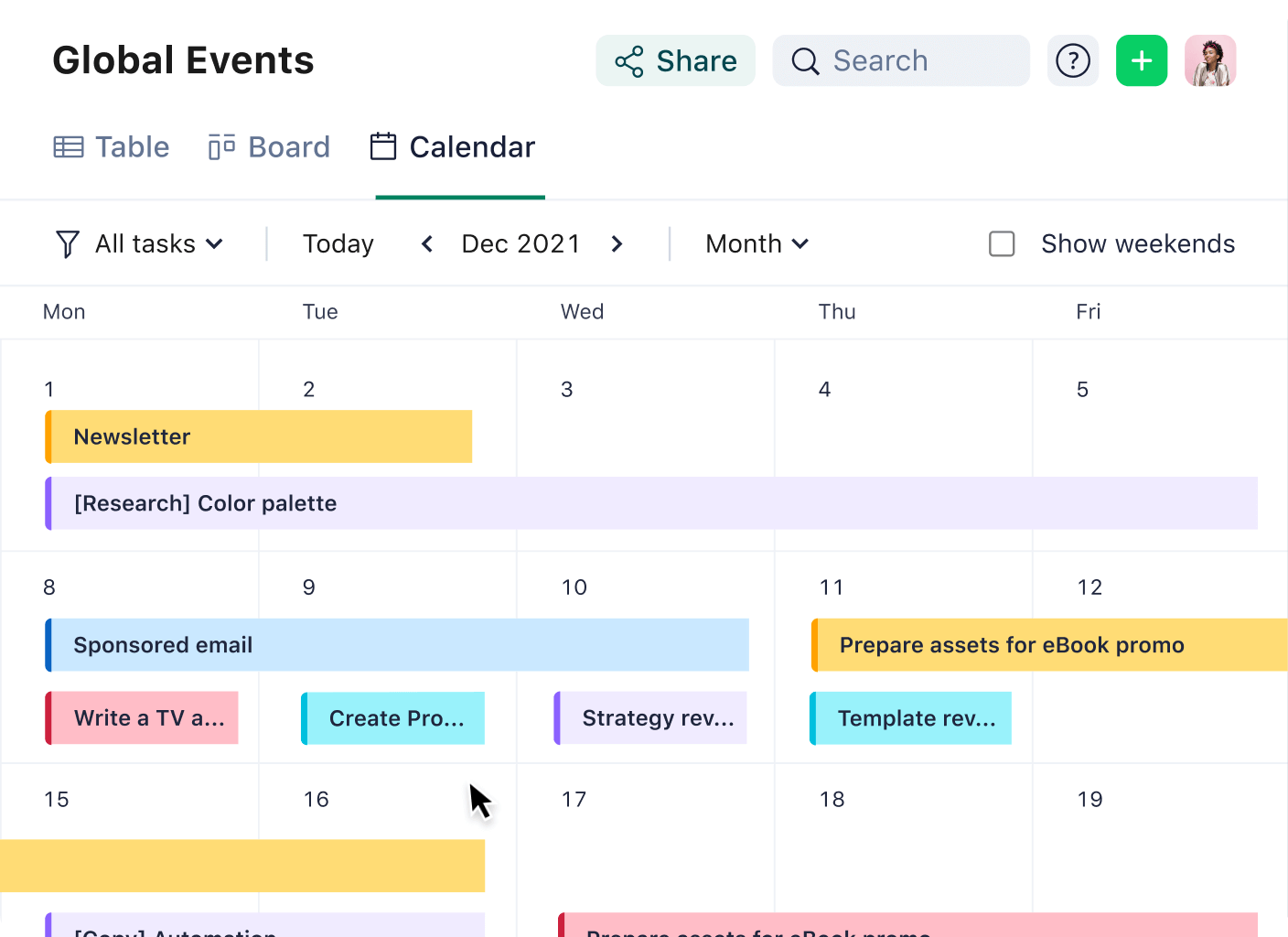

Image Source: wrike.com

Of course, creativity alone will only get you so far. It’s important to back up your ideas with solid data and analytics. By tracking the performance of your marketing efforts, you can see what’s working and what’s not, and make adjustments accordingly. This data-driven approach will help you make informed decisions and maximize your marketing potential.

In addition to creativity and data, consistency is also key. A successful marketing strategy is not a one-time effort, but a continuous process. By creating a marketing calendar and sticking to it, you can ensure that your efforts are consistent and cohesive, helping to build brand recognition and loyalty over time.

Another important aspect of unleashing your marketing potential is staying ahead of the curve. The marketing landscape is constantly evolving, with new trends and technologies emerging all the time. By staying informed and adapting to these changes, you can stay ahead of your competition and remain relevant in the eyes of your audience.

Finally, don’t be afraid to take risks. Sometimes, the biggest rewards come from taking a leap of faith and trying something new. Whether it’s experimenting with a new platform, launching a bold campaign, or partnering with a controversial influencer, taking calculated risks can help you break through the noise and make a lasting impact.

In conclusion, unleashing your marketing potential is all about understanding your audience, setting clear goals, getting creative, backing up your ideas with data, staying consistent, staying ahead of the curve, and taking risks. By following these steps and creating a winning marketing calendar, you can elevate your marketing strategy to new heights and achieve success in a competitive marketplace. So, what are you waiting for? It’s time to unleash your marketing potential and create a strategy that will set you apart from the competition.

Crafting a Calendar for Success

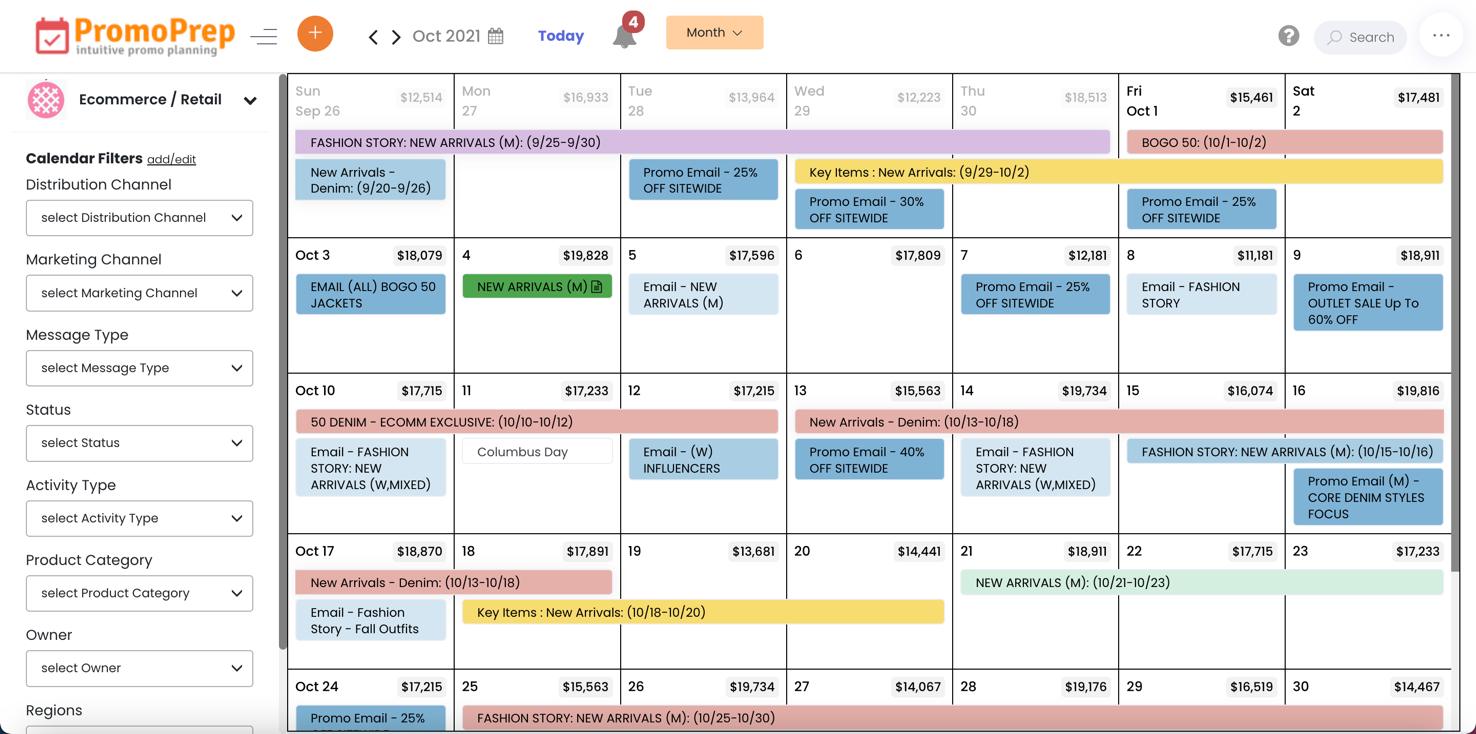

Image Source: cloudinary.com

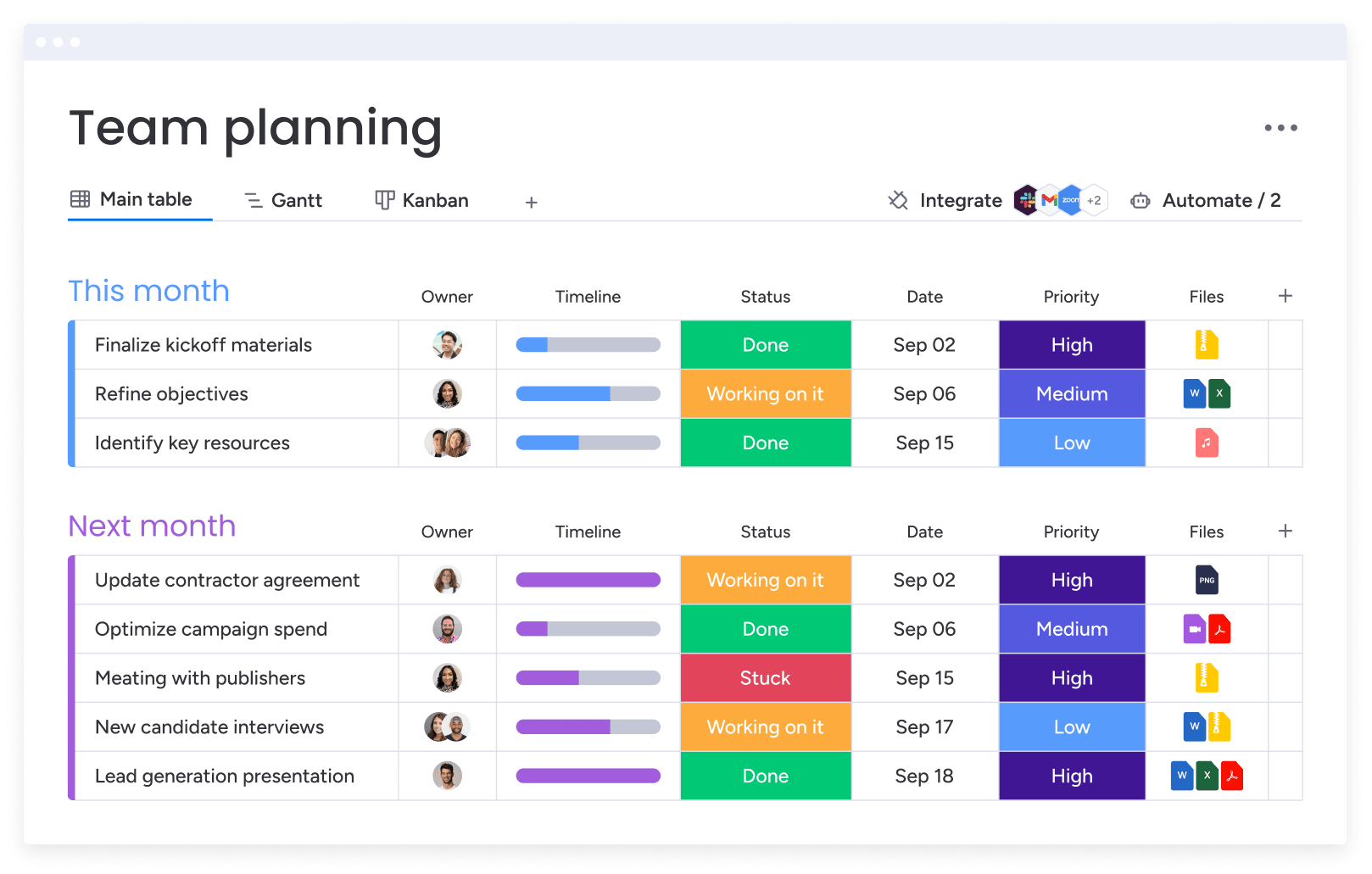

When it comes to mastering your marketing strategy, one of the most crucial tools you can have in your arsenal is a well-planned and organized marketing calendar. A marketing calendar is essentially a roadmap that guides your marketing efforts throughout the year, helping you stay on track, organized, and focused on your goals. In this article, we will explore the importance of crafting a calendar for success and provide you with some tips on how to create a winning marketing calendar.

A marketing calendar serves as a visual representation of your marketing plan, allowing you to see at a glance what needs to be done, when it needs to be done, and who is responsible for each task. By having a clear outline of your marketing activities, you can ensure that all your efforts are aligned with your overall business objectives and that you are making the most of your resources.

To create a successful marketing calendar, you first need to define your goals and objectives. What do you want to achieve with your marketing efforts? Are you looking to increase brand awareness, drive more traffic to your website, or boost sales? By clearly defining your goals, you can tailor your marketing calendar to focus on the activities that will help you achieve those objectives.

Once you have established your goals, the next step is to identify your target audience. Who are you trying to reach with your marketing messages? Understanding your target audience is essential for creating content that resonates with them and drives engagement. Your marketing calendar should include specific campaigns and activities that are designed to appeal to your target audience and address their needs and pain points.

When crafting your marketing calendar, it is important to take into account key dates and events that are relevant to your business. This could include holidays, industry conferences, product launches, or seasonal trends. By aligning your marketing activities with these events, you can capitalize on opportunities to reach your audience when they are most receptive to your messages.

Image Source: coschedule.com

Another important aspect of creating a winning marketing calendar is to establish a timeline for your activities. By setting deadlines for each task and campaign, you can ensure that everything stays on track and that you are able to meet your goals in a timely manner. This will also help you allocate resources effectively and avoid last-minute scrambling to get things done.

In addition to planning your marketing activities, it is also crucial to track and measure the success of your campaigns. By monitoring key performance indicators (KPIs) such as website traffic, social media engagement, and sales conversions, you can assess the effectiveness of your marketing efforts and make adjustments as needed. Your marketing calendar should include regular checkpoints for reviewing your KPIs and evaluating the performance of your campaigns.

Finally, don’t forget to include a mix of different marketing tactics in your calendar. This could include a Combination of online and offline activities such as social media posts, email campaigns, print ads, and events. By diversifying your marketing efforts, you can reach a broader audience and increase the likelihood of success.

In conclusion, crafting a calendar for success is an essential step in mastering your marketing strategy. By creating a well-planned and organized marketing calendar, you can align your marketing activities with your business goals, reach your target audience effectively, and track the success of your campaigns. With the right approach and a bit of creativity, you can create a winning marketing calendar that will help you achieve your marketing objectives and drive your business forward.

Image Source: cloudinary.com

How to Create a Marketing Calendar

Image Source: cloudinary.com

Image Source: promoprep.com

Image Source: squarespace-cdn.com

Image Source: cloudinary.com