Embrace Your Uniqueness

Crafting Your Creative Identity: A Step-By-Step Guide to Personal Branding for Creatives

In a world filled with competition and comparison, it can be easy to get lost in the crowd. However, as a creative individual, embracing your uniqueness is essential in establishing a strong personal brand. Your uniqueness is what sets you apart from others and makes you memorable to your audience.

Embracing your uniqueness starts with self-discovery. Take some time to reflect on what makes you different from everyone else. What are your strengths, passions, and quirks? Embrace these qualities and use them to your advantage in your creative endeavors.

One way to embrace your uniqueness is to focus on your personal story. Your experiences, background, and perspective are all part of what makes you who you are. Share these aspects of yourself with your audience through your work. Whether it’s through your writing, art, music, or any other creative medium, infuse your personal story into everything you create.

Image Source: creatopy.com

Another way to embrace your uniqueness is to celebrate your imperfections. No one is perfect, and that’s what makes us all human. Embrace your flaws and quirks, as they add depth and character to your work. Remember, perfection is overrated – authenticity is what truly resonates with people.

It’s also important to embrace your unique creative voice. Don’t try to mimic someone else’s style or tone. Instead, focus on developing your own voice that is true to who you are. Your unique perspective and approach to your craft is what will attract your audience and set you apart from the rest.

When it comes to personal branding, consistency is key. Make sure that your uniqueness shines through in everything you do – from your website and social media presence to your portfolio and projects. Your personal brand should be a reflection of who you are and what you stand for.

Lastly, don’t be afraid to take risks and push boundaries. Embracing your uniqueness means stepping outside of your comfort zone and trying new things. Experiment with different styles, techniques, and ideas to see what resonates with you and your audience. Remember, being true to yourself is the most important part of personal branding.

In conclusion, embracing your uniqueness is a crucial step in crafting your creative identity and building a strong personal brand. Celebrate what makes you different and use it to your advantage in everything you create. By embracing your uniqueness, you will stand out from the crowd and leave a lasting impression on your audience. So go ahead, embrace your uniqueness and let your creative voice shine!

Crafting Your Creative Identity: A Step-By-Step Guide to Personal Branding for Creatives

Build Your Creative Brand

Image Source: shopify.com

You’ve embraced your uniqueness, now it’s time to build your creative brand! Personal branding is the process of creating a unique identity and image for yourself in the professional world. As a creative, it’s important to showcase your individuality and talent through your personal brand. Here are some steps to help you build your creative brand and stand out in a crowded market.

1. Define Your Brand Identity

The first step in building your creative brand is to define your brand identity. This includes identifying your values, strengths, and unique selling points. What sets you apart from other creatives? What are your core beliefs and what do you stand for? Take some time to reflect on these questions and create a clear vision of your brand identity.

2. Create a Compelling Story

Every great brand has a compelling story behind it. Use your personal experiences, passions, and journey as a creative to craft a story that resonates with your audience. Your story should showcase your authenticity and humanize your brand. Whether it’s overcoming challenges, pursuing your dreams, or finding inspiration in everyday life, your story is what will connect you with your audience on a deeper level.

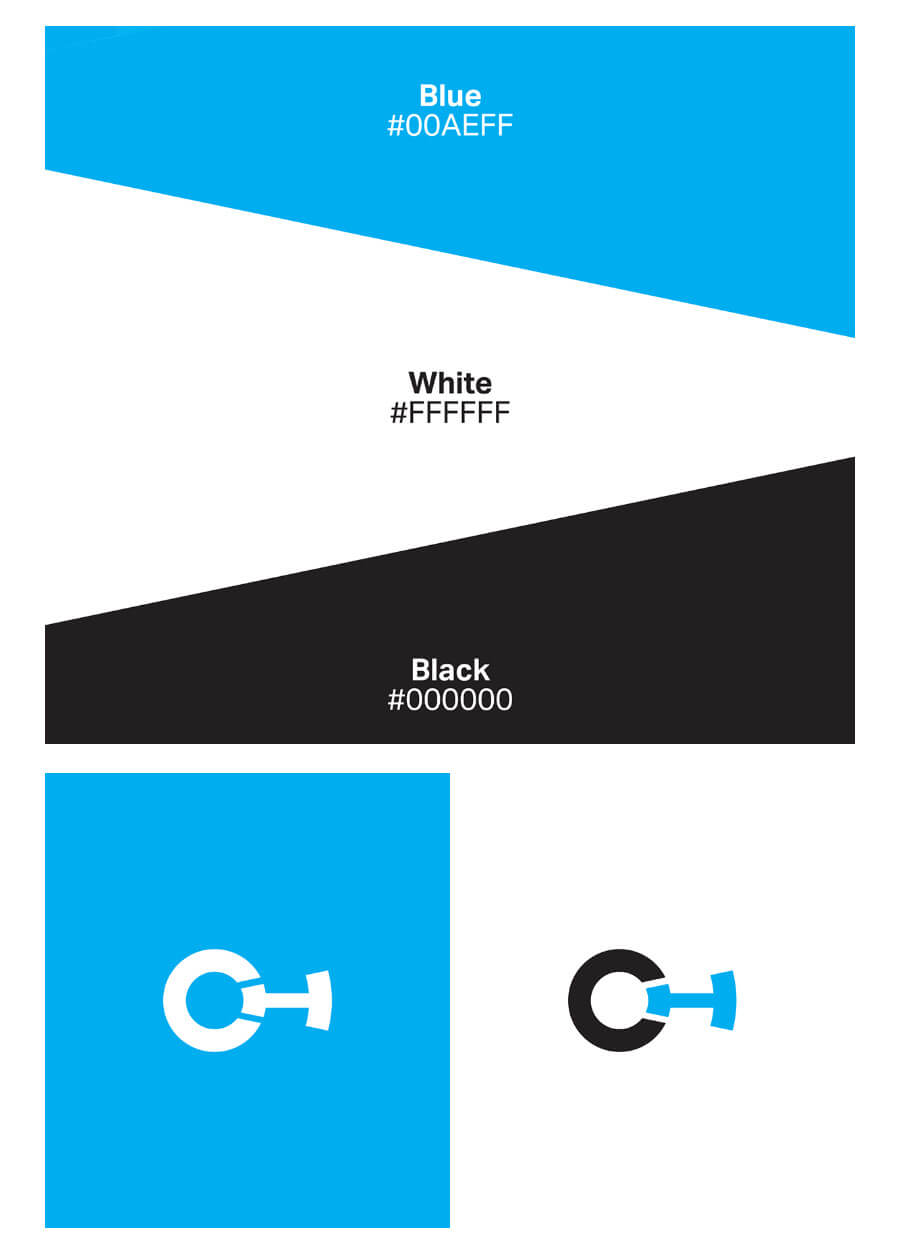

Image Source: creatopy.com

3. Develop Your Visual Identity

Your visual identity is an important aspect of your creative brand. This includes your logo, color palette, typography, and overall aesthetic. Choose elements that reflect your personality and style as a creative. Whether you prefer minimalist design, bold colors, or intricate patterns, make sure your visual identity is consistent across all platforms and materials.

4. Showcase Your Portfolio

As a creative, your portfolio is your most powerful tool for showcasing your talent and skills. Create a portfolio that highlights your best work and demonstrates your range as a creative. Whether you’re a graphic designer, photographer, writer, or artist, your portfolio should showcase the diversity of your work and the quality of your craftsmanship.

5. Establish Your Online Presence

Image Source: ytimg.com

In today’s digital age, having a strong online presence is essential for building your creative brand. Create a professional website or portfolio to showcase your work and attract Potential clients or collaborators. Use social media platforms such as Instagram, Twitter, and LinkedIn to connect with other creatives, share your work, and engage with your audience.

6. Network and Collaborate

Networking and collaboration are key components of building your creative brand. Attend industry events, workshops, and conferences to connect with other creatives and industry professionals. Collaborate on projects with other creatives to expand your network and gain exposure. Building relationships within the creative community is essential for growing your brand and opening up new opportunities.

7. Stay Authentic and Consistent

Authenticity is the cornerstone of a strong personal brand. Stay true to yourself and your values in everything you do. Be consistent in your brand messaging, visual identity, and storytelling. Your audience will appreciate your authenticity and be more likely to connect with you on a deeper level.

Image Source: creatopy.com

Building your creative brand is an ongoing process that requires time, effort, and dedication. By defining your brand identity, creating a compelling story, developing your visual identity, showcasing your portfolio, establishing your online presence, networking and collaborating, and staying authentic and consistent, you can craft a strong personal brand that reflects your unique creativity and talent. Embrace your uniqueness and let your creative brand shine!

Personal Branding for Creatives A Step-by-Step Guide

Image Source: shopify.com

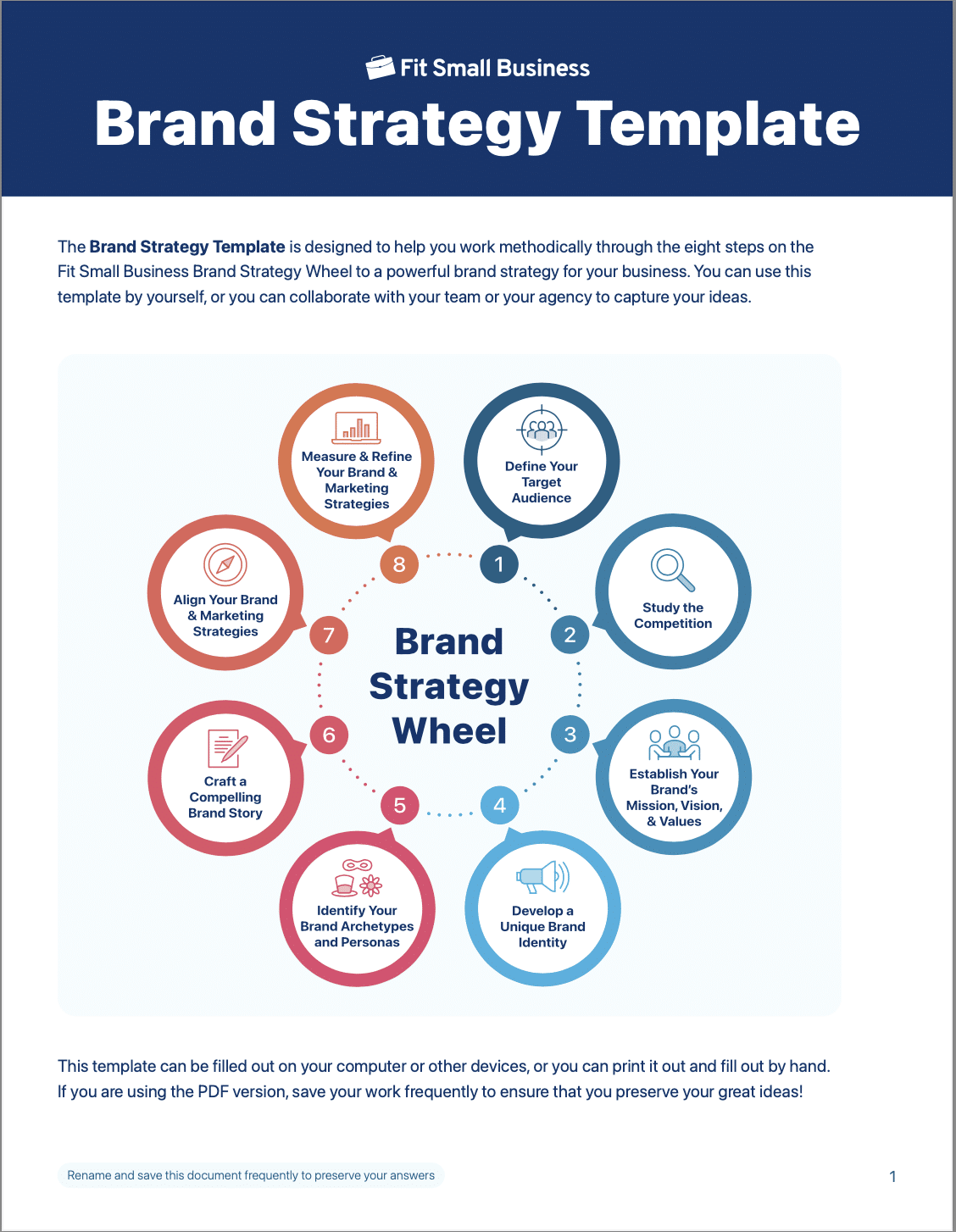

Image Source: fitsmallbusiness.com

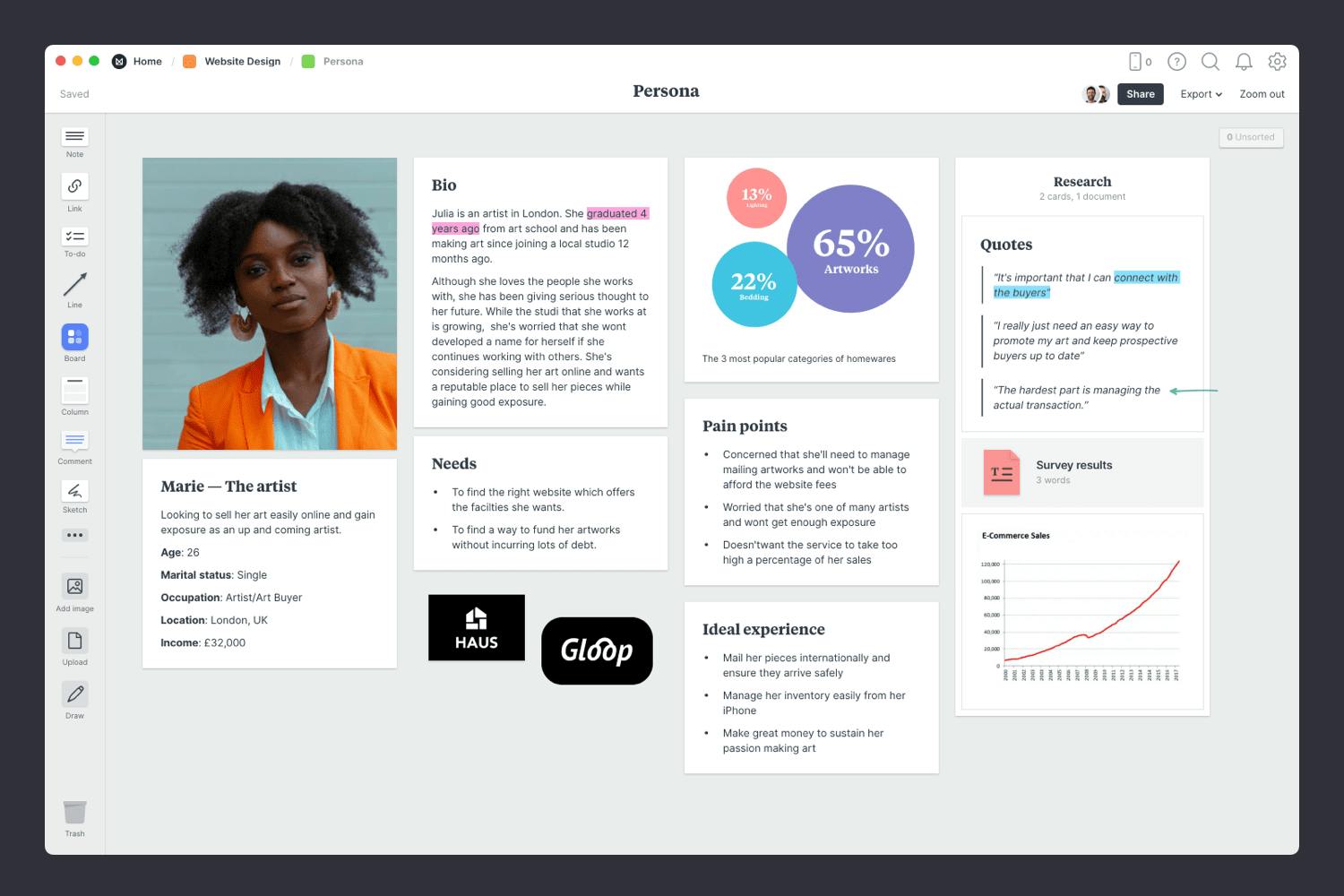

Image Source: milanote.com